The April 2026 Making Tax Digital (MTD) deadline is fast approaching for sole traders and landlords earning over £50,000, and one critical aspect often overlooked is the need for an MTD-compliant invoicing system. Traditional methods like generic invoice generators and manual record-keeping won’t meet HMRC's new digital standards, potentially leading to penalties and unnecessary admin work.

MTD-ready invoicing software not only ensures compliance but also simplifies business operations. With features like professional invoicing, automatic payment tracking, real-time tax estimates, and seamless quarterly submissions, MTD-compliant tools save time and reduce the burden of compliance, making it easier for sole traders and landlords to stay on top of HMRC regulations.

In this guide, we'll break down exactly what MTD means for your invoicing, the features you need in compliant software.

Key Takeaways

From April 2026, sole traders and landlords with turnover above £50,000 must use HMRC-recognised software to record all invoiced income digitally.

Standard invoice generators lack HMRC connectivity, automatic categorisation, and audit trail capabilities required for MTD compliance.

You’ll submit four quarterly summaries each year showing your invoiced income and expenses, making automated categorisation essential to avoid hours of manual work.

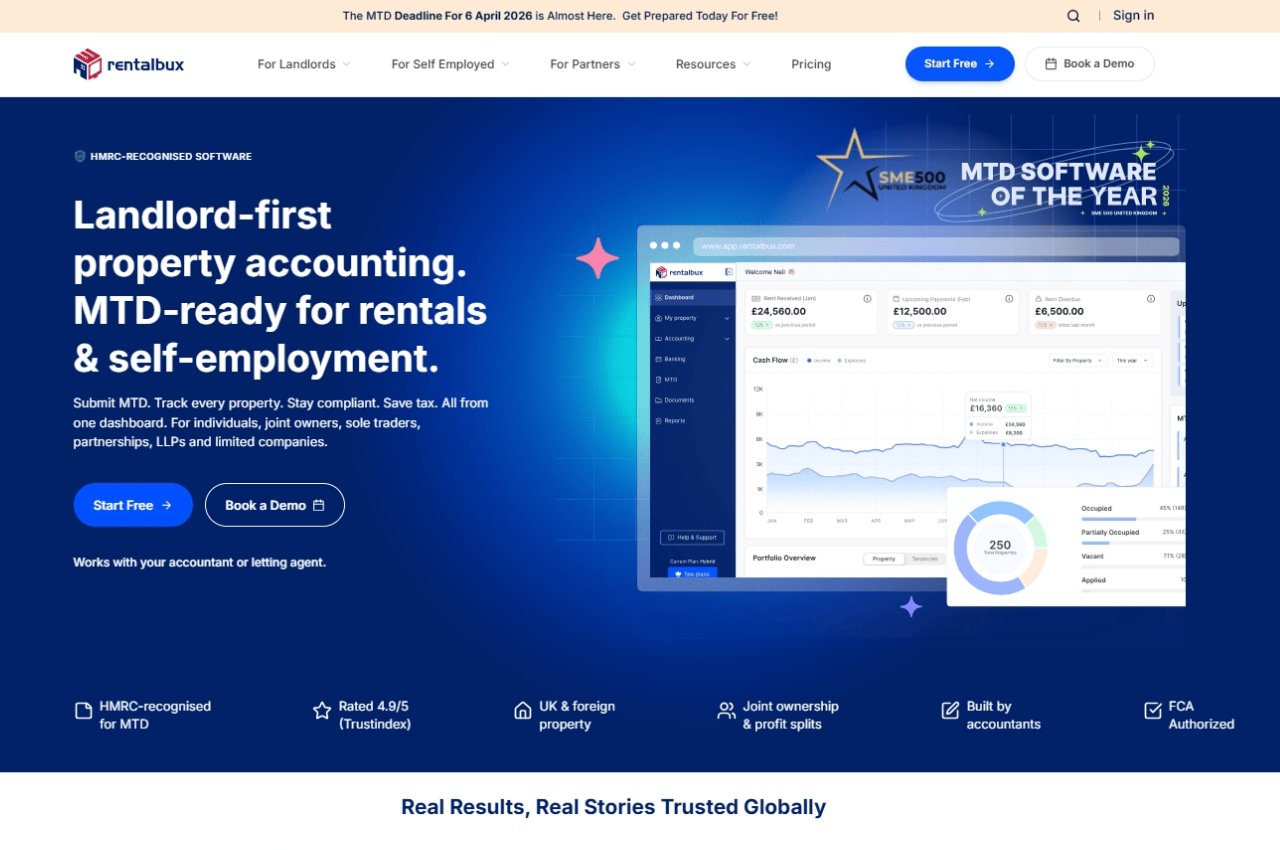

RentalBux connects invoicing, payment tracking, expense management, and HMRC submissions in one platform, unlike standalone invoicing tools.

Modern sole traders need the ability to create invoices, track payments, and manage finances from smartphones, not just desktop computers.

RentalBux offers free MTD features until March 2028 for landlords with a single property, giving you years to transition without cost.

What MTD Means for Your Invoices?

Making Tax Digital for Income Tax fundamentally changes how sole traders and landlords handle invoicing and income reporting. From 6 April 2026, if your (sole traders and landlords) income exceeds £50,000, you must use HMRC-recognised software to record all business income and expenses.

Digital Record-Keeping Standards

HMRC requires all income and expenses to be recorded digitally using MTD compatible software. This means manual spreadsheets, paper invoices, and traditional record-keeping methods no longer satisfy compliance requirements. While digital spreadsheets can be used if connected to HMRC systems through MTD-compatible bridging software. Your software must create a digital link between the invoices you send and the quarterly updates you submit to HMRC.

Quarterly Update Requirements

Under MTD, you'll submit four quarterly updates each year showing your income and expenses. These updates follow specific standard calendar period.

Alternatively, you can choose to use calendar quarters (January to March, April to June, July to September, and October to December), depending on your preference or business needs. Whichever period you choose, the deadline remains same.

It would be better if your invoicing software should automatically categorise and tally invoiced income for each period, making it easier to generate accurate quarterly submissions to HMRC without manual data entry or complex calculations.

Information Your Invoicing Software Should Track

MTD-compliant software should capture and store specific information for every invoice:

The amount of the transaction

The date of the transaction, based on how the person records transactions for income tax purposes

The category the transaction belongs to, as specified in the system

This detailed record-keeping creates an audit trail that satisfies HMRC requirements while giving you clear visibility into your business finances.

Why Standard Invoicing Tools Aren't Enough?

The Compliance Gap

Invoice generators that lack HMRC MTD integration cannot submit quarterly updates directly to HMRC, requiring you to manually transfer data to separate MTD-compliant software. They can't automatically categorise income for tax purposes, don't maintain the required audit trail for quarterly updates, and cannot generate the end-of-year tax summaries MTD requires.

The Time Cost

Without integrated MTD software, you're stuck manually transferring invoice data to separate accounting tools. This creates double-entry work, increases the risk of errors, and leads to last-minute scrambling before quarterly deadlines.

Traditional vs MTD-Ready Invoicing

Feature | Traditional Invoicing | MTD-Ready Invoicing |

|---|---|---|

HMRC Connectivity | None | Direct submission capability |

Automatic Categorisation | Manual sorting required | AI-powered categorisation |

Quarterly Reporting | Export and manual compilation | One-click update generation |

Tax Calculation | External tools needed | Real-time tax estimates |

Payment Tracking | Manual reconciliation | Automatic bank sync matching |

Essential Features of MTD Invoicing Software

When evaluating MTD invoicing software, understanding which features are essential versus nice-to-have helps you make an informed choice. Here's what truly matters for compliance and efficiency.

HMRC Recognition and Integration Your software must be HMRC recognised. This recognition means the platform has passed HMRC's technical specifications and can communicate directly with HMRC systems through secure API connections. Without this, you cannot submit quarterly updates digitally as required under MTD. Digital Record-Keeping Cloud-based storage with automatic backups ensures your invoicing records are secure and accessible anywhere. The software must maintain a complete audit trail showing when invoices were created, sent, viewed, and paid. HMRC requires you to keep records for five years, so your chosen platform needs reliable long-term storage. Income Categorisation Automatic categorisation by income type is crucial for accurate tax reporting. The software should intelligently sort invoices into appropriate tax categories and support multiple income streams if you offer diverse services. You should be able to tag invoices with different tax treatments when needed. Payment Tracking Automatic recording when invoices are paid is essential for cash basis reporting, which records income when you receive payment rather than when you send the invoice. Integration with bank feeds automatically matches incoming payments to outstanding invoices, updating your records without manual intervention. Client Management A built-in customer database stores payment history, contact details, and payment terms for each client. Automated payment reminders sent to clients at configurable intervals (for example, 7 days after an invoice becomes overdue) improve cash flow and reduce the time you spend chasing payments. Mobile Accessibility Modern sole traders work from various locations. Your MTD invoicing software should offer mobile apps for iOS or Android, allowing you to create and send invoices on the go. The ability to capture expense receipts with your phone camera and match them to invoices streamlines your entire financial workflow. |

RentalBux MTD Invoicing Software: Purpose-Built for Sole Traders

While the market offers numerous invoicing solutions, RentalBux stands out as purpose-built MTD software designed specifically for UK landlords. Sole traders can also find RentalBux a useful platform. Here's why thousands of business owners trust RentalBux for their MTD-compliant invoicing.

Why RentalBux Stands Out for MTD Compliance?

Built Specifically for UK Tax Compliance | Unlike generic invoicing tools, RentalBux is specifically designed by UK accountants to meet HMRC's MTD requirements. As HMRC-recognised software, it ensures full compliance and seamless quarterly submissions, addressing the real challenges faced by landlords and sole traders. |

Seamless Multi-Income Stream Management | RentalBux handles both trade invoicing and rental income in one platform, with automatic tax separation and separate quarterly updates for each income type, simplifying the annual return and eliminating the need for multiple software. |

Designed for Non-Accountants | RentalBux features an intuitive interface with guides and videos, simplifying MTD compliance. It streamlines invoice creation, categorization, and quarterly submissions, making it easy for landlords and sole traders to manage compliance without complex accounting terms. |

Automatic Bank Feed Reconciliation | RentalBux integrates with your bank accounts to automatically match incoming payments to outstanding invoices, ensuring accurate cash basis reporting. This eliminates manual tracking and records income when payment is received, which is essential for quarterly MTD submissions. |

Mobile-First Invoice Management | With RentalBux's Android app, you can create invoices, send payment reminders, and track payments on the go. It also allows you to capture expense receipts with your phone camera, automatically categorizing and linking them to invoices, ensuring your MTD records are always up-to-date. |

Exceptional Value with Transparent Pricing | RentalBux offers transparent pricing with no hidden fees or long-term contracts. The Free plan is available for one property or business until March 2028. Paid plans include:

|

Conclusion

The April 2026 Making Tax Digital deadline requires sole traders and landlords to adopt MTD-compliant invoicing software. Traditional methods like manual spreadsheets and generic invoice generators create compliance gaps, inefficiencies, and the risk of penalties. Without the right software, staying on top of quarterly updates, accurate record-keeping, and tax estimates becomes increasingly difficult.

Starting with MTD-compliant software now not only ensures compliance but also helps you avoid last-minute stress. Transitioning early means you’ll be better prepared, reducing the chances of errors and ensuring your business runs smoothly in line with new tax requirements.