Self-Employed Landlord? Stop Paying for Two Subscriptions Track Rental & Business Income.

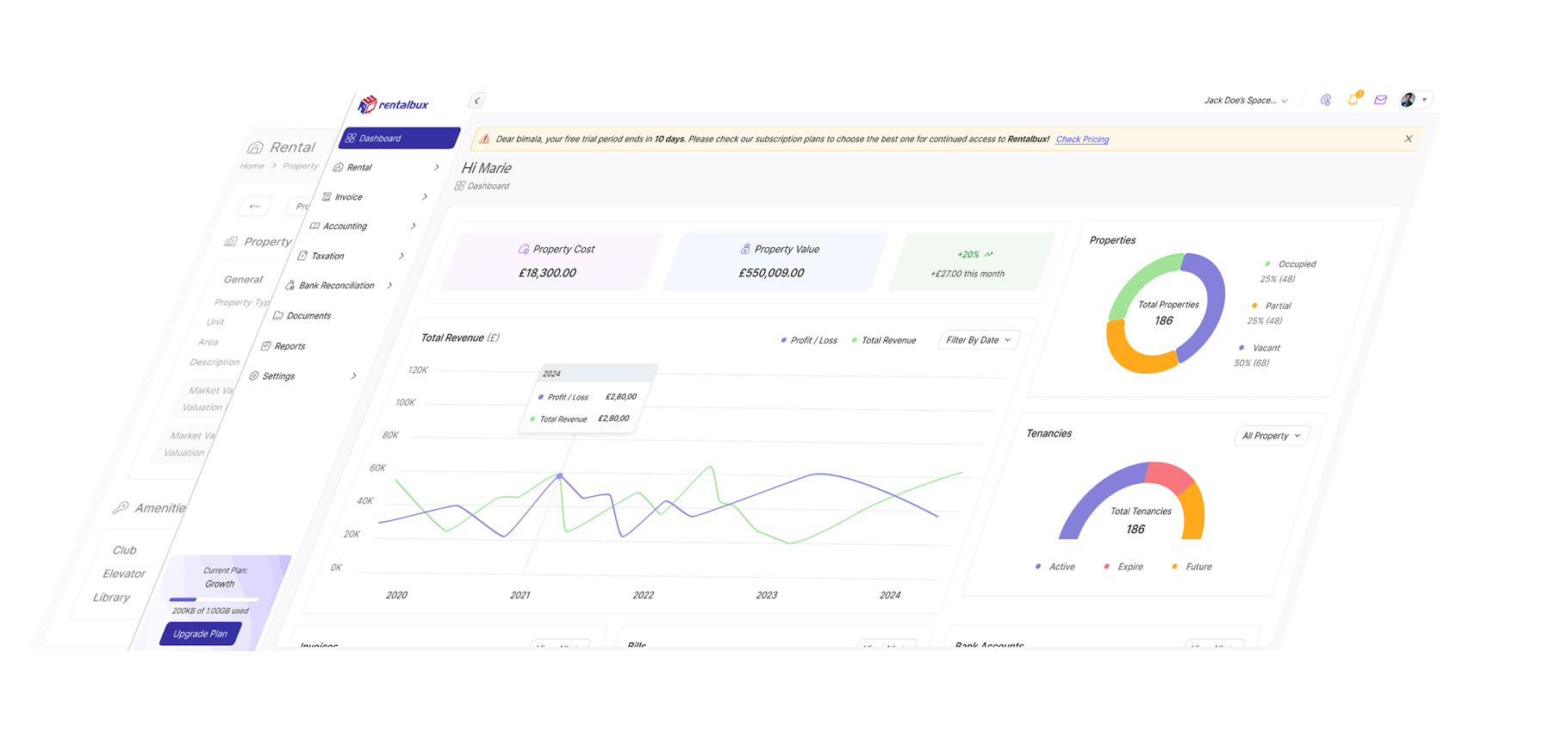

RentalBux combines landlord and self-employed income tracking with full MTD compliance. Manage property and business income in one place.

No more switching between systems. No more paying twice. Just clear visibility into both businesses.

"I was paying £48 monthly for two different software subscriptions—one for my rental properties and another for my consultancy business. Then at tax time, I'd spend hours manually matching figures between systems. RentalBux eliminated that completely. Everything is in one place now. I track client income and rental income separately, get individual profit reports for each business, and submit one MTD return to HMRC. The consolidation alone saves me 8-10 hours every quarter, not to mention £360 annually on software. And my accountant charges less now because everything's already organised."

Jennifer M.

What Our Other Users Say

"Running a trade business and managing rental properties used to mean two software subscriptions and hours of manual work. RentalBux handles both perfectly—one platform, one price, everything organised."

- James T., Builder & Landlord

"As a consultant with rental properties, I love having separate profit reports for each business. It's so clear which income stream performs better, and the combined MTD submission is seamless."

- Emma L., Consultant & Property Investor

4.9/5

Average Rating in Trustindex

Two Income Streams, One Simple Solution for Self-Employed Landlords

You’re running two businesses—rental income and self-employment. Stop paying for separate software. RentalBux combines rental and business accounting, keeping both income streams separate but manageable in one platform with MTD compliance.

RentalBux solves both problems.

It's purpose-built for landlords who also have self-employment income. Track rental properties with all the landlord-specific features you need. Track self-employment income with proper invoicing and expense management. Keep both income streams separate for reporting but manage everything in one platform with one subscription.

All-in-One Platform for Rental & Business Income—One Price, Full MTD Compliance

RentalBux is the perfect self-employed landlord software, managing both rental and self-employment income in one platform. Track property income and business expenses separately for tax purposes, and submit combined MTD returns to HMRC effortlessly. No need for separate subscriptions or software.

RentalBux keeps your rental and self-employment income completely separate for tax purposes while managing everything in one unified system. You get property-level income and expenses tracking for every rental. Invoice creation and expenses management for your business. Individual profit and loss reports for each income stream. And when it's time for MTD submissions, RentalBux calculates both automatically to HMRC in one go.

Built For Landlords Who Also Run Businesses.

Every feature is designed to give you complete visibility into both income streams without paying for two separate systems or spending hours reconciling data.

Dual Income Stream Tracking

Track rental income, self-employment earning completely separately within one platform. Rent from each property is recorded and categorised as rental income. Client invoices and business earnings are tracked as self-employment income. Both are managed in one dashboard, but reported individually for tax purposes. See total earnings across both businesses or drill down into each income stream independently. Make informed decisions about where to focus your time and investment based on actual profitability data.

Separate Profit & Loss Reporting

Generate individual profit and loss reports for your rental portfolio and self-employment business. See exactly how much profit each property generates. Understand your business margins. Compare performance between income streams. Your accountant gets clean, organised reports for both businesses without needing to consolidate multiple software systems. This clarity often reduces accountant fees by £200-400 annually since they spend less time preparing your records.

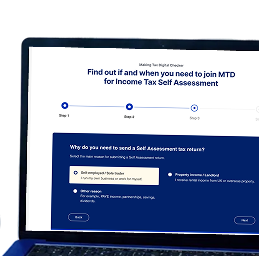

Combined MTD Submissions

Under Making Tax Digital for Income Tax Self-Assessment, rental and self-employment income must be submitted separately to HMRC but can be done in one quarterly update. RentalBux calculates both income streams independently, then submits everything to HMRC in one go. No manual combination required. No confusion about whether you need separate submissions. The system handles it all automatically while keeping your records properly organised for both businesses.

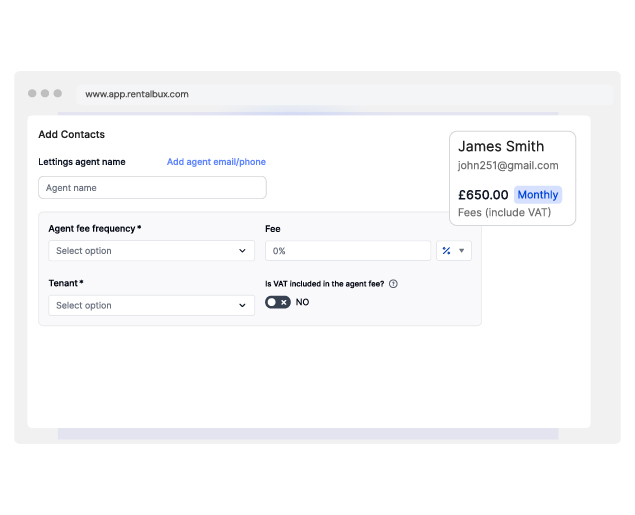

Bank Feed Integration for Multiple Accounts

Connect your rental property bank account and your business bank account separately. Transactions from your property account automatically categorise as rental income or rental expenses. Transactions from your business account flow into self-employment categories. No manual switching. No confusion about which transaction belongs to which business. Everything imports automatically and stays properly organised.

Joint Ownership Support for Rental Properties

If you own rental properties jointly with a spouse, partner or investor, RentalBux automatically splits rental income and expenses based on ownership percentages. Your self-employment income remains entirely separate and solely yours. Each co-owner receives their correct share of rental profit for tax purposes while your business income is tracked independently. No manual calculations. No confusion at tax time.

Receipt Scanning & OCR for Both Businesses

Snap a photo of any receipt—whether it's a property repair invoice or a business expense—and RentalBux extracts the amount, date, supplier, and description using AI. Assign it to the correct property or mark it as a business expense. Everything is stored digitally for MTD compliance. No more typing receipts manually. No more lost paperwork.

Self-Employed Landlords

Who Benefit from One Platform

If you earn income from both rental properties and self-employment, RentalBux eliminates the need for separate software while keeping your records properly organised for HMRC.

Tradespeople who own Rental Properties

You work as a builder, plumber or electrician while renting out residential properties. Track job income and materials separately from rental income and property expenses. Submit one combined MTD return covering both businesses. See which business—your trade or your rentals—actually generates better returns.

Consultants and Coaches with Rental Income

You run a consultancy, coaching or professional services business and own rental properties. Track client income and project expenses alongside rental income and property costs. Generate separate profit reports to understand each income stream. See which business—your trade or your rentals—actually generates better returns.

Freelancers who Rent Out Property

You take on freelance contracts while earning rental income from one or more properties. Allocate expenses correctly between business and property, maintain clear records for HMRC, and submit quarterly updates covering both income sources without manually combining different systems.

eCommerce Sellers with Rental Properties

You sell products online—whether through Amazon, eBay, Shopify, or your own website—and own rental properties. Track product sales, inventory costs, and platform fees separately from rental income and property expenses. See which business generates better margins. Maintain clear records for HMRC across both income streams.

Creative Professionals Who Invest in Property

You work as a photographer, videographer, musician or artist while building a rental property portfolio. Track project income and equipment costs alongside rental income and property management. Generate individual reports for your creative business and rental portfolio. Understand which income stream provides more stability and better returns.

Part-Time Business Owners with Rental Income

You run a side business—tutoring, cleaning services, pet care, catering—alongside earning rental income. Track both income streams in one platform with proper MTD compliance for each. No need to pay for expensive business accounting software when your income doesn't yet justify the cost. One simple subscription covers everything.

How RentalBux Compares for Self-Employed Landlords

See why landlords with self-employment income choose RentalBux over managing separate software subscriptions.

| Feature | Two Separate Subscriptions | Other Accounting Software | RentalBux |

|---|---|---|---|

| Property Accounting |

|

Limited

|

Full-featured

|

| Self-Employment Tracking |

|

|

|

| One Platform |

|

|

|

| Property-Level Reporting |

Sometimes

|

|

|

| Separate Profit Reports |

|

Manual

|

Automatic

|

| Combined MTD Submission |

|

|

|

| One Subscription Price |

|

N/A

|

|

| Joint Ownership Splits |

Rare

|

|

|

Start Free - See the Difference Yourself

Experience the power of MTD-compliant software built specifically for landlords. No credit card required.

FAQ for Self-Employed Landlords

Common questions about managing rental property income alongside self-employment income, combining both income streams for MTD compliance, and using RentalBux to handle everything in one platform.

Can I use one software for both rental and self-employment income?

Yes. RentalBux is purpose-built for landlords who also have self-employment income. One platform tracks both income streams separately, generates individual profit reports and submits MTD returns to HMRC. No need for separate subscriptions.

Do rental income and self-employment income need separate MTD submissions?

Yes. Under Making Tax Digital for Income Tax Self-Assessment, your rental property income and self-employment income needs separate quarterly submission to HMRC. RentalBux calculates both income streams separately then makes automatic MTD submission.

How does RentalBux separate rental and self-employment income?

Rentalbux provides you the flexibility to report your income and expenses as per your income stream. RentalBux tracks each income stream separately and generates individual profit and loss reports while keeping everything in one platform.

Can I track multiple properties and multiple self-employment incomes?

Yes. RentalBux tracks unlimited rental properties with property-level income and expense reporting and can keep record for multiple self-employment incomes.

What if my self-employment income is below the MTD threshold but rental income pushes me over?

MTD applies when your total qualifying income (rental plus self-employment) exceeds £50,000. If your combined income is above this threshold, you must use MTD software for both income streams. RentalBux tracks everything and handles the combined submission.