MTD Software for Sole Traders: Replace Your Spreadsheet with HMRC-Recognised Software

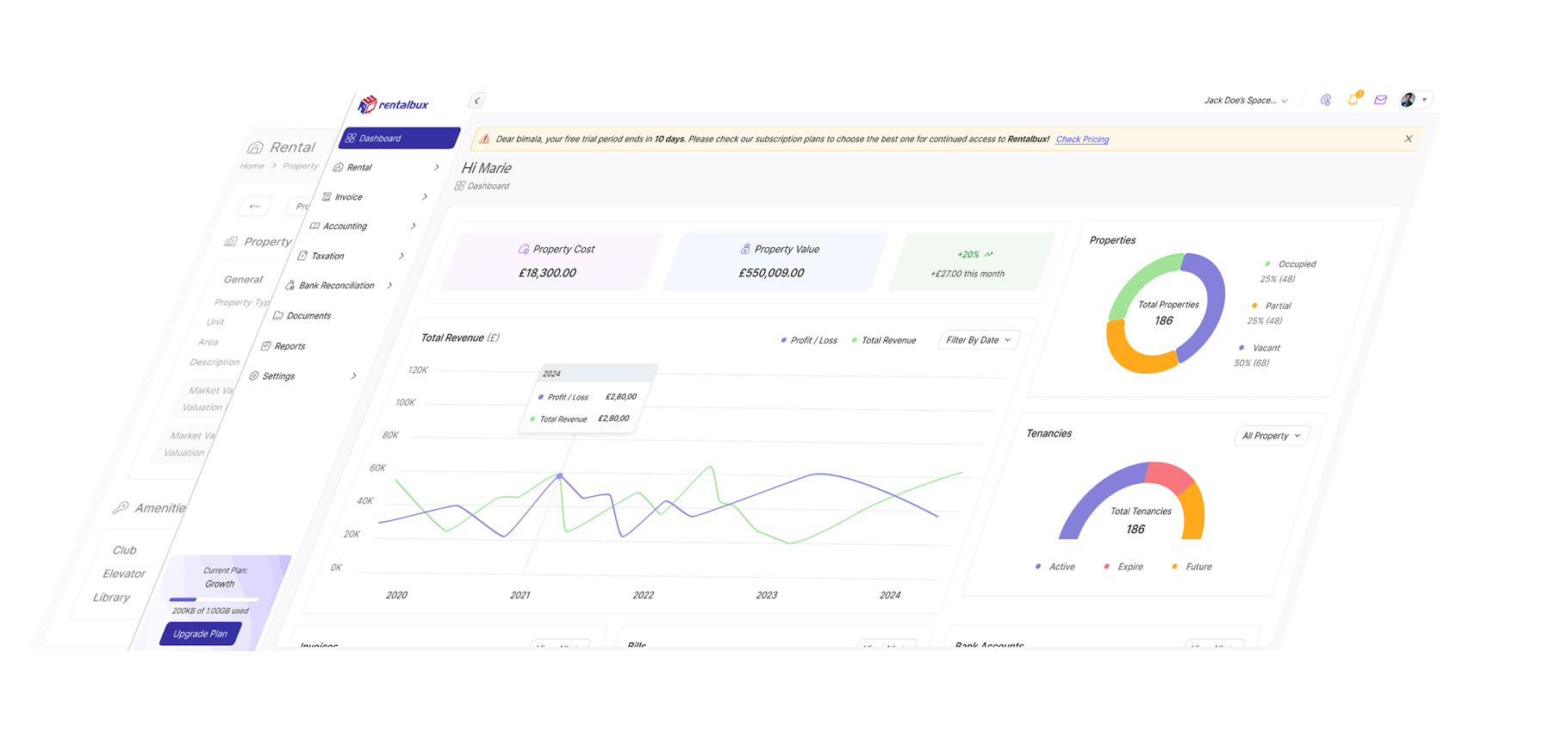

Starting April 2026, sole traders earning over £50,000 must use Making Tax Digital (MTD) software for quarterly HMRC submissions. RentalBux is simple, HMRC-recognised MTD software designed for sole traders—no bookkeeping experience needed.

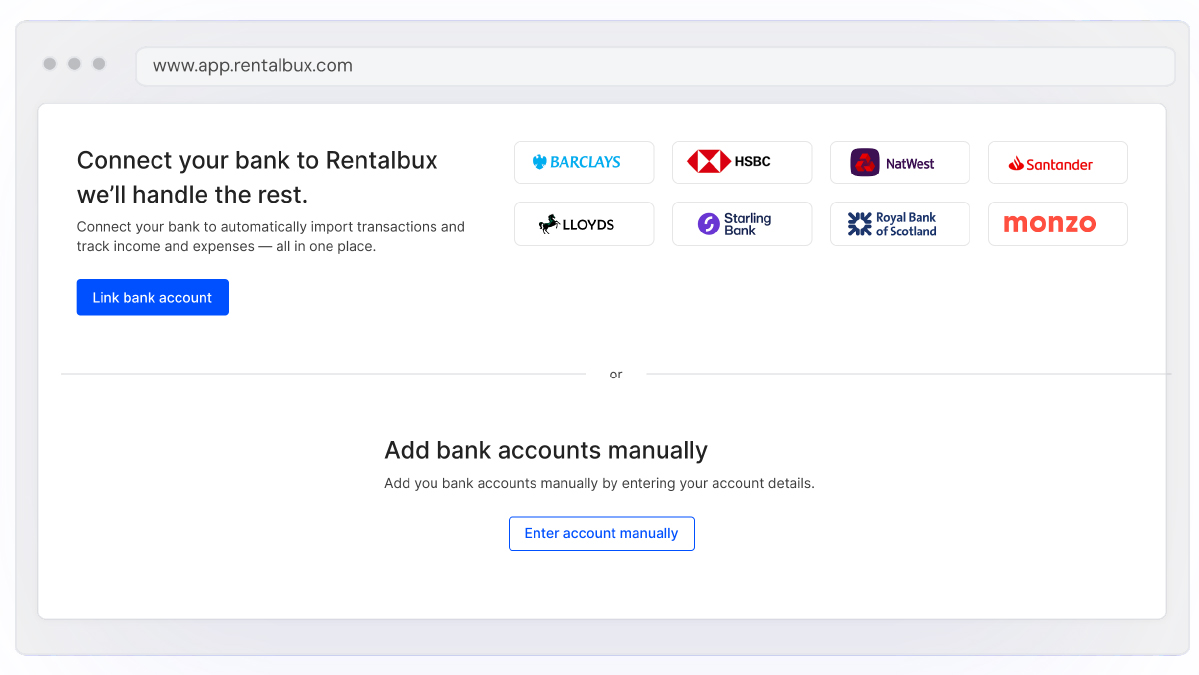

No double-entry bookkeeping or charts to configure. Just connect your bank, categorise transactions, and let RentalBux handle the rest. When HMRC deadlines arrive, your quarterly figures are ready to submit.

"I ran my joinery business on Excel for nine years. When my accountant explained MTD would need proper software, I panicked—I'm good with wood, not computers. Tried two different accounting packages and gave up on both within a week. Too many menus, too much jargon. Then a mate recommended RentalBux. Set it up in one evening. Bank transactions pull through automatically, I photograph receipts when suppliers hand them over, and the quarterly submission took eleven minutes. Eleven minutes! My accountant now just reviews my year-end figures instead of rebuilding everything from my spreadsheets. Saved me £600 in fees last year."

Steve H.

What Our Other Users Say

4.9/5

Average Rating in Trustindex

Say Goodbye to Spreadsheets: Here's the MTD Software You Need

For years, a spreadsheet worked—track income, expenses, hand it to your accountant. But starting April 2026, HMRC's Making Tax Digital (MTD) rules require sole traders to use compatible software for digital record-keeping and quarterly submissions. RentalBux fills the gap—simple, HMRC-recognised MTD software designed specifically for sole traders.

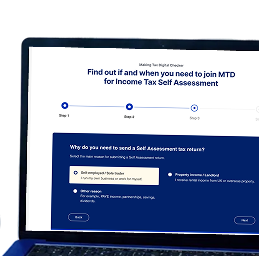

How Sole Traders Can Submit Quarterly Tax Updates to HMRC—A Step-by-Step Guide

MTD compliance sounds complicated. With the right software, it's not. Here's exactly how RentalBux handles your sole trader quarterly submissions:

Digital Record Keeping for Sole Traders—Easy, MTD-Compliant, No Learning Curve

Every feature exists to solve a specific sole trader problem. No bloat. No features you'll never use. Just what you need for MTD compliance.

Automatic Bank Transaction Import

Connect once, import forever. Every payment in and out appears in RentalBux automatically. No CSV exports. No manual entry. No transactions slipping through the cracks because you forgot to log them.

Smart Expense Categories for Sole Traders

Pre-configured categories match what HMRC expects: cost of goods sold, vehicle expenses, premises costs, admin expenses, professional fees. The software learns which suppliers go in which category and applies the same logic to future transactions.

Mobile Receipt Capture with OCR

Open the app, point at the receipt, tap. Optical character recognition reads the amount, date, and supplier. The receipt image attaches to the matching transaction. Five seconds, done. HMRC-compliant digital records without the filing cabinet.

Quarterly Calculation Engine

RentalBux continuously calculates your quarterly position. At any moment, you can see total income, total expenses, and profit for the current quarter. When submission time comes, the figures are already there—no end-of-quarter scramble.

Direct HMRC Submission

Submit your quarterly update without leaving RentalBux. The software connects directly to HMRC's MTD systems. You review the figures, click submit, and receive instant confirmation. No bridging software. No separate HMRC login. No copying numbers between systems.

Submission History & Audit Trail

Every quarterly submission is logged with timestamp, figures submitted, and HMRC confirmation reference. If HMRC ever queries your returns, you have a complete record of exactly what was submitted and when.

Is Making Tax Digital Different from Self-Assessment

for Sole Traders?

This confuses a lot of sole traders. Let's clear it up.

Self-Assessment (What You Do Now)

Once a year, you total up your business income and expenses, complete a tax return, and submit it to HMRC by 31 January. You can keep records however you like—paper, spreadsheet, software, napkins (not recommended). HMRC doesn't see anything until your annual return.

Making Tax Digital (What Changes)

Instead of one annual submission, you send HMRC four quarterly updates throughout the year, plus a final declaration after year-end. Records must be kept digitally in MTD-compatible software. HMRC gets visibility into your tax position in near-real-time.

What Stays the Same

- The tax you owe is calculated the same way

- Allowable expenses remain the same

- Tax payment deadlines don't change

- You can still use an accountant if you want

What Changes

- Reporting frequency: quarterly instead of annual

- Record keeping: must use MTD-compatible software

- Submission method: through software, not HMRC website

- The final declaration replaces your traditional self-assessment return

The Bottom Line

MTD doesn't change your tax bill—it changes how and when you report. Think of it as self-assessment broken into smaller, more frequent chunks, with stricter rules about how you keep records. RentalBux handles both the quarterly reporting and prepares your final declaration.

MTD Software for Sole Traders Across Every Trade

Sole traders aren't one-size-fits-all. A mobile hairdresser has different needs to a website developer. RentalBux works across all sole trader types.

Construction & Manual Trades

Builders, plumbers, electricians, roofers, decorators. Track materials by job, log travel between sites, handle CIS deductions if you work for contractors. Capture receipts on site before they end up in the washing machine.

Service Providers

Cleaners, gardeners, dog walkers, personal trainers, tutors, mobile beauticians. Simple income tracking for regular clients. Mileage logging for travel between appointments. Straightforward expense categories for supplies and equipment.

Professional Services

Consultants, coaches, bookkeepers, copywriters, designers. Invoice clients professionally, track project-based income, claim software subscriptions and professional memberships. Home office expense tracking included.

Drivers & Delivery

Couriers, delivery drivers, private hire. Mileage tracking is critical—RentalBux calculates your allowance automatically using HMRC rates. Track vehicle running costs, phone expenses, and platform fees.

Retail & Market Traders

Market stall holders, craft sellers, eBay/Etsy traders. Track cost of goods sold, marketplace fees, packaging costs. Handle mixed cash and card sales. Manage stock-related expenses.

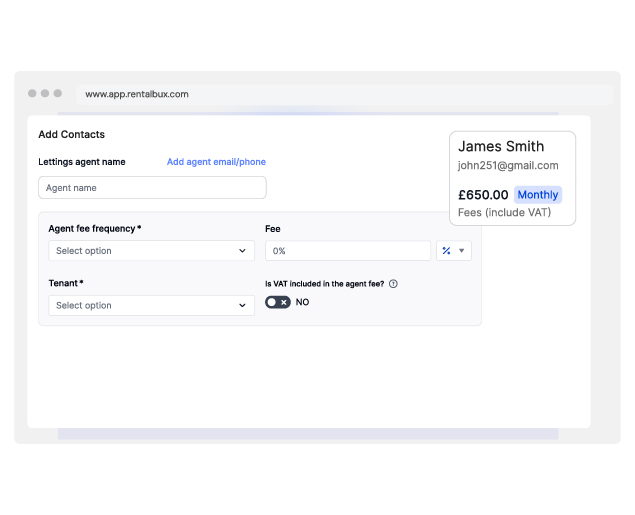

Sole Traders with Rental Property

Run a trade and own rental property? You need software that handles both income types with proper separation for HMRC. RentalBux was built for exactly this scenario—one subscription, both income streams, combined quarterly submissions.

Best MTD Software for Sole Traders—How Options Compare

Choosing MTD software? Here's how the main options stack up for sole traders.

| Feature | RentalBux | Spreadsheet + Bridge | Free Bank App | Full Accounting Software |

|---|---|---|---|---|

| Designed for Sole Traders | Yes |

DIY |

Basic |

Generic |

| HMRC-Recognised | Bridge only |

Some |

||

| Ease of Use | Simple |

Manual |

Simple |

Complex |

| Bank Feed Import | Auto |

Manual |

Auto |

Auto |

| Receipt Scanning | Included |

Extra |

||

| Mileage Tracking | HMRC Rates |

Manual |

Extra |

|

| Direct HMRC Submission | Built-in |

Via bridge |

Some |

Built-in |

| Multiple Income Types | Trade + Rental |

Manual |

Single |

Complex |

| Setup Time | Minutes |

Hours |

Minutes |

Days |

| Typical Cost | £ Affordable |

£ Low |

Free |

£££ Expensive |

Start Free—See the Difference Yourself

MTD-compliant software built specifically for sole traders. No credit card required.

Get Started FreeFAQ: Making Tax Digital for Sole Traders

Common questions about MTD compliance, quarterly submissions, digital tax reporting, and self-assessment for sole traders.

What is Making Tax Digital for sole traders?

Making Tax Digital (MTD) is HMRC's system for digital tax reporting. For sole traders, it means keeping business records in compatible software and sending quarterly summaries to HMRC throughout the year, rather than just one annual tax return. The aim is more accurate tax reporting with fewer errors and surprises.

Do sole traders need MTD software?

If your sole trader gross income exceeds £50,000 (from April 2026) or £30,000 (from April 2027), yes—MTD-compatible software is mandatory. You cannot submit quarterly updates through the HMRC website or using paper forms. The software must be on HMRC's approved list and connect directly to their systems.

When does Making Tax Digital start for sole traders?

MTD for Income Tax becomes mandatory in April 2026 for sole traders with qualifying income over £50,000. The threshold drops to £30,000 in April 2027. If you're below these thresholds, MTD doesn't apply yet—but you can join voluntarily to get used to the system before it becomes compulsory.

Can sole traders still use spreadsheets for MTD?

Not on their own. If you want to keep using a spreadsheet for day-to-day record keeping, you need 'bridging software' to submit the data to HMRC. This adds complexity and cost. Most sole traders find it simpler to move entirely to MTD software like RentalBux, which can import your historical spreadsheet data during setup.