Maximise Tax Deductions:Track Self-Employed Expenses with Ease

Stop missing out on tax deductions. RentalBux tracks self-employed expenses automatically, from mileage to home office costs, with HMRC-compliant receipt scanning and expense categorisation. Claim everything you're entitled to—no accounting knowledge needed.

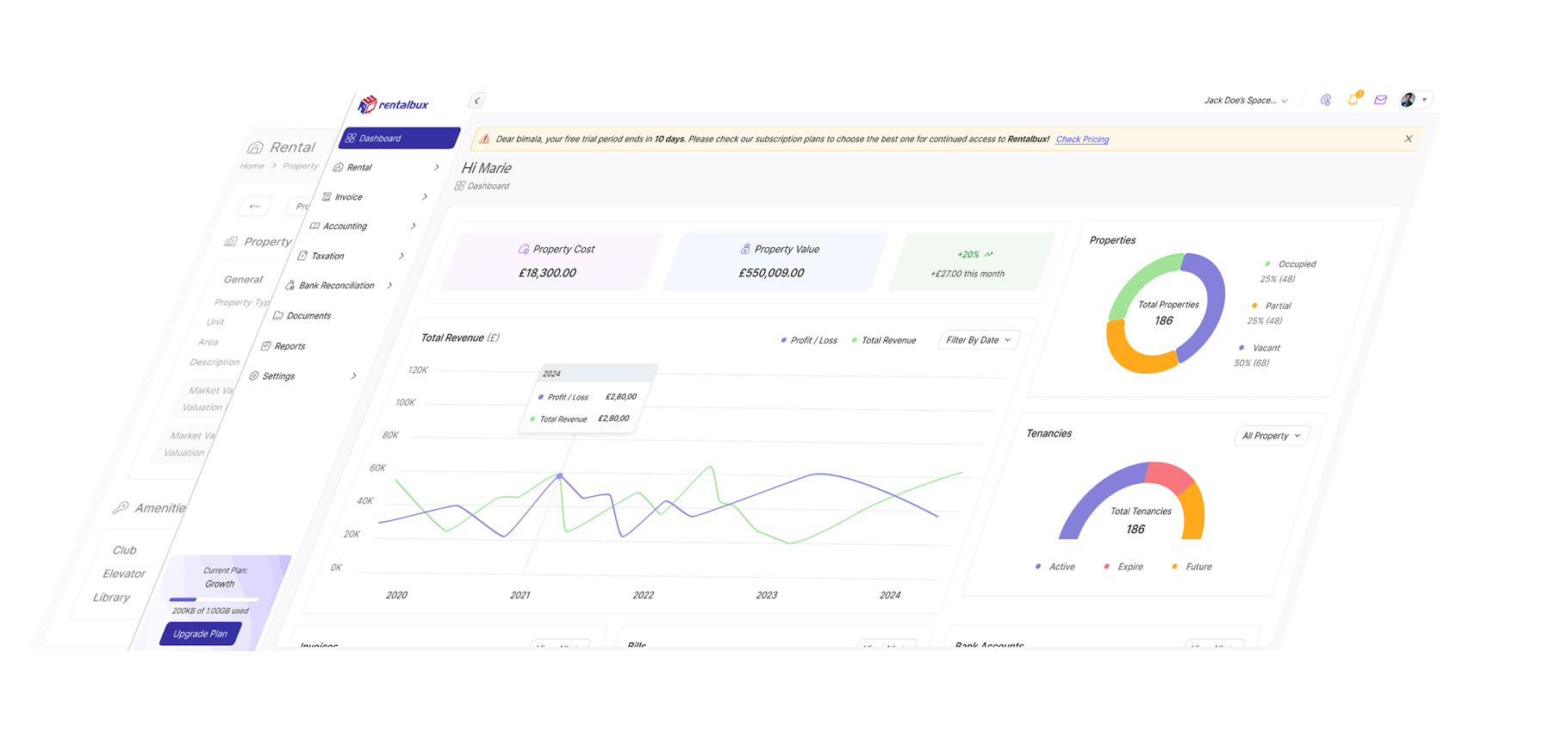

"I used to dread tax time. Receipts everywhere, bank statements piled up, always worried I was missing something or claiming wrong. Last year I switched to RentalBux and everything changed. I photograph receipts as I get them, the software pulls out the details automatically, and when quarterly submissions come around, it's all organised and ready. I claimed £2,800 more in legitimate deductions this year than I ever managed manually. The mileage calculator alone saved me hours."

David R.

What Our Other Users Say

"Running a trade business and managing rental properties used to mean two software subscriptions and hours of manual work. RentalBux handles both perfectly—one platform, one price, everything organised."

- James T., Builder & Landlord

"As a consultant with rental properties, I love having separate profit reports for each business. It's so clear which income stream performs better, and the combined MTD submission is seamless."

- Emma L., Consultant & Property Investor

4.9/5

Average Rating in Trustindex

Tired of Shoebox Receipts? Track Deductions Easily with the Right Expense Software

As a busy self-employed professional, tracking expenses often gets overlooked. When tax time comes, you’re left scrambling for receipts and hoping you haven’t missed any deductions. With RentalBux, you’ll capture every allowable expense—automatically, and with HMRC-compliant records to back it up.

Turn Receipts into Tax Deductions in Seconds with Automated Expense Tracking

Snap a photo, connect your bank, and let RentalBux do the rest—no manual entry or accounting skills needed. Receipt details are extracted automatically, transactions categorised, and business mileage tracked—everything organised and ready for HMRC claims

Built Around the Real Challenges

Self-Employed People Face

with Expenses

Every feature designed to capture deductions you'd otherwise miss—without the complexity of traditional accounting software.

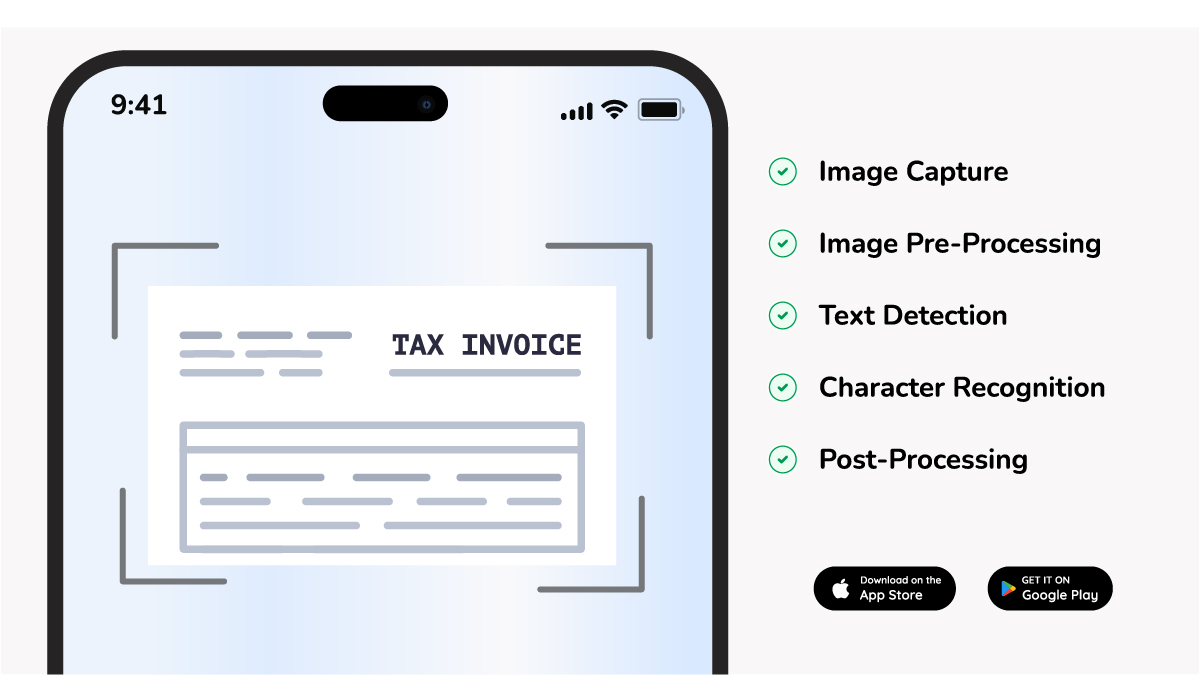

OCR Receipt Scanning

Photograph of any receipt using your phone. Optical character recognition extracts the amount, date, supplier, and expense category automatically. The expense is stored digitally, categorised correctly, and linked to the right transaction. No typing. No lost paperwork. Receipts captured in seconds, stored securely forever.

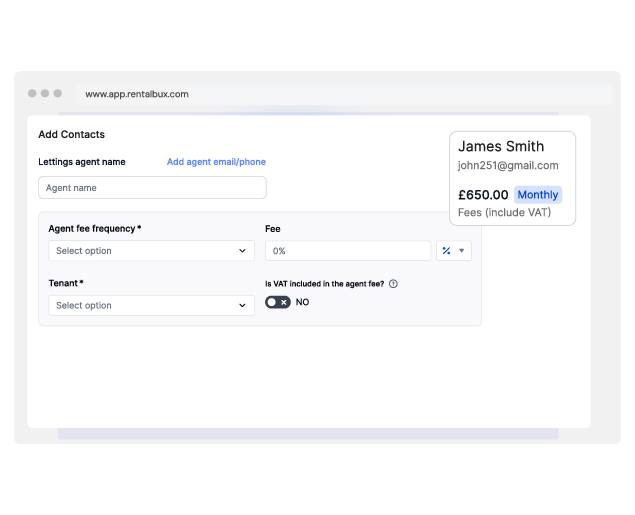

Intelligent Bank Feed Categorisation

Connect your business bank account and transactions import automatically. RentalBux learns your business patterns and categorise expenses intelligently—fuel purchases, office supplies, professional subscriptions. Review and adjust if needed, but most transactions categorise themselves correctly from day one.

Mileage Calculator

Log business journeys and RentalBux calculates your mileage allowance using HMRC's approved rates: 45p per mile for the first 10,000 miles, 25p thereafter. No more manual calculations or guesswork. Accurate mileage deductions with a complete record for HMRC.

Built for Self-Employed People

Who Actually Work.

If you earn self-employed income and want to claim every deduction you deserve, RentalBux captures expenses properly—whatever your business looks like.

Tradespeople and Contractors

Work as a plumber, electrician, builder or decorator. Track materials, tools, vehicle costs and job-related expenses by project. Capture receipts on site before they're lost. Claim everything you're entitled to with records that stand up to scrutiny.

Consultants and Professional Services

Run a consultancy, coaching practice or advisory business. Track client entertainment, professional subscriptions, software costs and home office expenses. Generate clean expense reports that make year-end straightforward.

Freelancers and Creative Professionals

Take on multiple projects and clients throughout the year. Allocate expenses by project, track equipment purchases and claim working from home costs. Keep income streams separate while maintaining one organised expense record.

Mobile and Delivery Businesses

Spend your working life on the road? The mileage calculator alone can save you hundreds in missed deductions. Track fuel, parking, vehicle maintenance and every business journey with accurate records for HMRC.

New Sole Traders

Just starting out and unsure what you can claim? RentalBux guides you through allowable expenses with built-in categories that follow HMRC rules. Build good habits from day one—before poor record keeping costs you money.

Your Guide to Allowable Business Expenses

RentalBux tracks all allowable business expenses and helps you claim legitimate tax deductions while maintaining HMRC-compliant records.

Vehicle and Travel Expenses

Business mileage, fuel, parking, vehicle insurance, road tax, repairs and breakdown cover. Claim mileage allowance using simplified mileage rates (45p per mile for first 10,000 miles) or claim actual vehicle costs.

Home Office Expenses

If you work from home, claim a proportion of rent, mortgage interest, council tax, utilities and home insurance. Use HMRC's simplified £6 per week rate or calculate actual costs based on office space percentage. RentalBux includes a home office calculator.

Equipment and Supplies

Computers, tools, machinery, office furniture, stationery and any other equipment needed for your business. Capital items over £1,000 may qualify for Annual Investment Allowance, allowing full deduction in year of purchase.

Professional Fees and Subscriptions

Accountant fees, professional indemnity insurance, trade association memberships, industry subscriptions and software subscriptions directly related to your business.

Marketing and Advertising

Website costs, business cards, advertising spend, social media promotion and any other marketing expenses incurred to promote your business and attract customers.

Training and Development

Courses, seminars and training that improve existing skills for your current business. Note that training for entirely new skills or qualifications may not be allowable under HMRC rules.

How RentalBux Compares for Expense Tracking

See why self-employed professionals choose RentalBux over manual tracking or basic expense apps.

| Feature | Manual Spreadsheets | Other Expense Apps | RentalBux |

|---|---|---|---|

| OCR Receipt Scanning |

|

Sometimes

|

Included

|

| Automatic Bank Feeds |

|

Rare

|

Included

|

| AI Categorisation |

|

Basic

|

Learns your business

|

| Mileage Tracking |

Manual

|

|

Auto calculations

|

| Home Office Calculator |

|

|

Built-in

|

| MTD Compliance |

|

Rare

|

Full compliance

|

| Multi-Currency |

|

Rare

|

Included

|

| HMRC Audit Trail |

Manual

|

Limited

|

Complete

|

Start Free - See the Difference Yourself

Experience the power of MTD-compliant software built specifically for landlords. No credit card required.

FAQ: Expenses & Tax Deductions for the Self-Employed

Common questions about tracking business expenses, claiming tax deductions and maintaining HMRC-compliant records as a self-employed person.

What business expenses can self-employed people claim on tax returns?

You can claim any expense that is wholly and exclusively for business purposes. Common allowable expenses include vehicle costs, equipment, office supplies, professional fees, marketing, business insurance, training and use of home costs. Expenses with a personal element cannot be claimed unless you split out the business portion.

What expenses are not allowable for self-employed tax purposes?

You cannot claim personal expenses, client entertainment, business clothing (unless it is protective workwear or a uniform), commuting from home to a permanent workplace, fines or penalties, or any expense with a significant private use element unless you split out the business portion.

What is the difference between capital expenses and revenue expenses?

Revenue expenses are day to day running costs like stationery, fuel and repairs that are fully deductible in the year incurred. Capital expenses are purchases of assets like vehicles, computers or machinery that last several years. Capital items may qualify for capital allowances or Annual Investment Allowance, allowing full or partial deduction.

Can I claim simplified expenses or do I need actual costs?

For some expense types like vehicle costs and use of home, HMRC allows simplified expenses (flat rate calculations) or actual costs (detailed receipts). You can choose either method from year to year.