Joint Property, Multiple Owners. Split Profit Automatically.

"If you're managing joint property, Rentalbux is a game-changer. It makes splitting income and expenses effortless and allows you to assign profit shares across multiple properties in just a few clicks. The platform is intuitive, saves you time, and ensures everything stays transparent and organised, perfect for upcoming MTD compliance. Save yourself the headache of manual calculations and let Rentalbux handle the hard work."

Joshua

Shared property. Manual splits.

Double the work. There’s a better way.

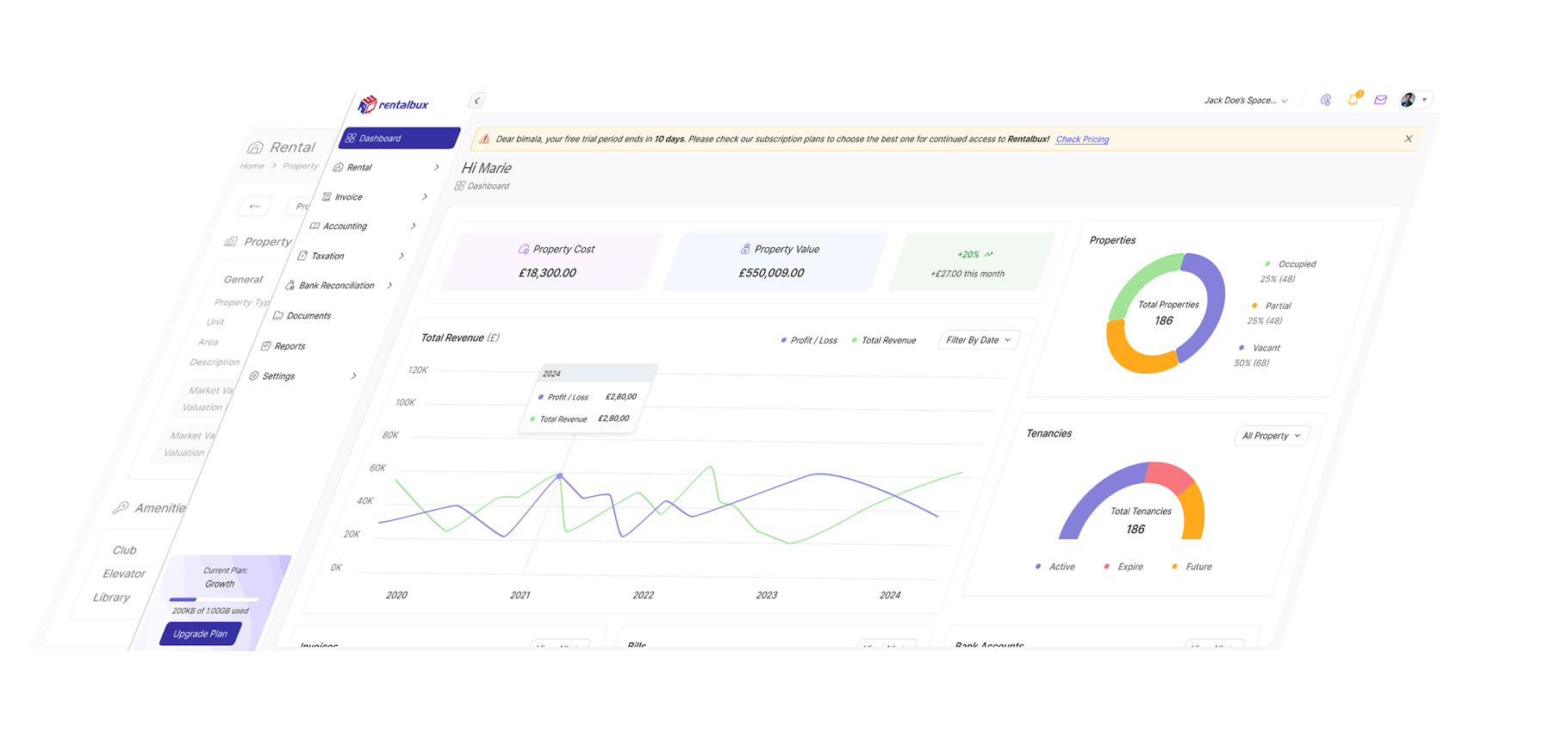

Own rental property with your spouse, partner, or business associate? Stop managing two separate accounts. RentalBux automatically splits rental income, expenses, and MTD submissions based on your ownership percentages-whether 50:50, 45:35:30, or any custom arrangement.

Set Up Joint Ownership in Minutes.

Allocate properties, assign ownership percentages, and

automate your reporting all in one place.

Under Making Tax Digital (MTD), each co-owner must report their individual share of rental income and expenses to HMRC quarterly. RentalBux handles this automatically set up once, and every transaction, report, and submission is split correctly.

Add Co-Owners & Set Ownership Percentages

Easily add multiple property co-owners and define each person's ownership percentage

Assign Properties to Co-Owners

Link properties to owners and view automated profit splits across your entire portfolio

View Reports & Track Performance

Access detailed reports, track MTD deadlines, and monitor your rental property performance

Submit to HMRC

MTD compliant filing

Add Co-Owners

Set ownership percentages

Assign Properties

Link properties to owners

View Reports

Individual owner reports

Submit to HMRC

MTD compliant filing

Set Your Split Once.

RentalBux Handles the Rest.

Accurate profit allocation, effortless quarterly reporting, and full compliance with HMRC's MTD ITSA automatically.

Automatic Profit Splits

Rental income and expenses are automatically divided between all co-owners based on the percentages you set. No manual intervention required.

Instant Separate Reports

Generate separate income and tax reports for each co-owner instantly. No manual tracking or duplication.

Full compliance with Making Tax Digital for Income Tax Self Assessment. Submit each co-owner's share directly to HMRC with a few clicks. No spreadsheets, no errors.

Who Benefits from Automatic

Profit Splits?

Whether you own property with a spouse, business partner, or family member - RentalBux splits income, expenses, and MTD submissions automatically.

Married Couples and Civil Partners

You and your spouse/partner own rental property jointly. HMRC allows you to elect for unequal profit shares if you own the property as tenants in common. RentalBux automatically calculates and reports each partner's share, ensuring your MTD submissions reflect the correct ownership percentages.

Business Partners

You own multiple properties with a business associate on a 60:/40 or 70:/30 basis. Instead of maintaining two separate accounting systems, RentalBux automatically splits all income and expenses, giving each partner a clear, accurate record for their tax return.

Family Investments

You have invested in property with a parent, sibling, or adult child. Each co-owner needs their own MTD submission, but managing this manually is time-consuming and error-prone. RentalBux handles the split for you - reducing admin and ensuring compliance.

How RentalBux Compares to

Other Solutions

Compare the RentalBux joint ownership solution vs. maintaining two separate accounts with traditional property management software.

| Feature | Spreadsheets | Other accounting software | RentalBux |

|---|---|---|---|

| Automatic profit splits |

Manual calculation required

|

Not supported or requires two accounts

|

Fully automated

|

| MTD ITSA compliance |

No integration

|

Limited or requires bridging software

|

Direct submission to HMRC

|

| Separate reports for each owner |

Manual export and formatting

|

Possible but time consuming

|

Generated automatically

|

| Cost for joint owners | Free but high admin burden | £20+ per month per owner | One subscription covers up to three owners |

| Audit trail and accuracy |

Prone to errors

|

Depends on manual setup

|

Fully auditable and accurate

|

Start Free - See the Difference Yourself

Experience the power of automated profit splits and MTD-compliant reporting. No credit card required.

Get Started FreeFAQ for Joint Ownership & Profit Splits

Common questions about managing jointly owned rental properties and automatically splitting income, expenses, and MTD submissions between co-owners.