What are you required to do under MTD for income tax?

Making Tax Digital for Income Tax changes when and how you report to HMRC, but you’re still tracking the same income and expenses, claiming the same allowances, and paying tax at the same rates. Your three main obligations work together as an integrated system:

Digital Record-Keeping: You’ll maintain electronic records throughout the year using compatible software, capturing every transaction with the correct amount, date, and HMRC tax category.

Quarterly Updates: You’ll send summary reports to HMRC four times yearly, showing your income and expenses for each three-month period

Final Declaration: You’ll complete an annual submission by 31 January, confirming your total position and claiming reliefs and allowances.

These obligations flow naturally from one to the next; your digital records feed into quarterly updates, which build toward your final declaration.

Digital Record Keeping

Under MTD for Income Tax, digital record-keeping comes with clear requirements. Every transaction, whether income or expense, must be recorded with its amount, date, and the correct HMRC tax category. If you run multiple trades or property businesses, each one must be maintained separately in digital form to avoid confusion. At the same time, you must also retain the original supporting documents, such as invoices, receipts, or bank statements, alongside your digital records, as HMRC requires these to be kept for a minimum of six years. These digital entries form the foundation for all quarterly updates and final declarations, so accuracy and consistency are critical.

Simplified Reporting Option

For those with income below the £90,000 VAT threshold, HMRC allows simplified reporting through “three-line accounts.” This means you can report your total income, total expenses, and overall profit or loss without breaking everything down by category. However, landlords should note that residential finance costs, such as mortgage interest, must still be shown separately, even when using this simplified option.

Digital Record Categories for Self-Employed Individuals

For self-employed taxpayers, HMRC requires you to keep digital records of both income and expenses. Income is divided into two main categories: turnover, which covers all sales, services, or professional fees, and other business income, such as commissions or rent from business premises.

On the expense side, records must capture costs of goods and materials, payments to subcontractors under CIS, and all staff-related costs, including wages and salaries. You’ll also need to track business travel and vehicle use, premises-related expenses like rent, power, and insurance, and the repair or maintenance of property and equipment. Office and admin costs, such as phones and stationery, as well as marketing and advertising, also fall under HMRC’s list. Finance-related costs (interest, loan charges, and bank fees), professional fees (accountancy, legal, and consultancy), and any other allowable expenses must also be included.

Digital Record Categories for Property Landlords

For landlords, HMRC separates income into total rent, other property income (e.g. service charges, insurance claims), lease premiums, and reverse premiums.

Expenses must be recorded under key headings, including running costs (such as rent, rates, insurance, and ground rents), property repairs and maintenance, and finance costs. These are split between residential (e.g. mortgage interest) and non-residential finance costs. Legal, management, and professional fees, as well as service provision (such as staff wages), and property-related travel, also need to be tracked, along with any other allowable property expenses.

For foreign property, the same categories apply, but landlords must also maintain records for currency conversions and overseas tax implications, keeping them distinct from UK property records.

Quarterly Reporting (QR Updates)

Quarterly reporting represents the most visible change under MTD, requiring you to submit income and expense summaries to HMRC four times each year instead of once. These submissions aren’t tax calculations; they’re informational updates that help HMRC track your business performance throughout the year.

Quarterly Periods and Deadlines

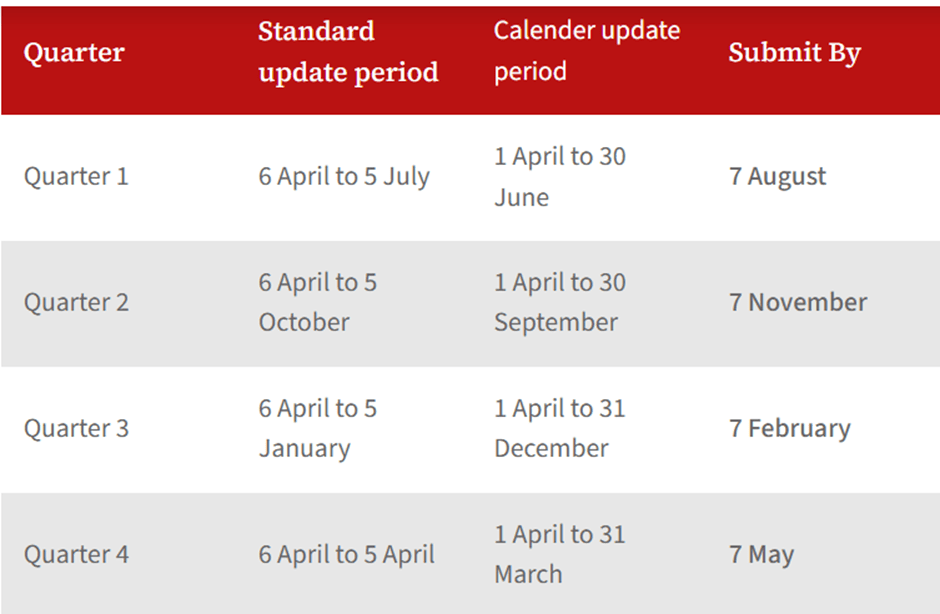

You can choose between a standard period or a calendar period for updates. Each quarterly update must be submitted by the 7th of the month following the quarter end.

What Goes in Quarterly Updates

Each quarterly update includes summary totals of income and expenses for that three-month period. You’re not submitting detailed transaction lists or supporting documentation; instead, you’re submitting categorised totals that your MTD software calculates from your detailed records.

Handling Irregular Income and Expenses

Your quarterly figures won’t be perfectly even, some months have high costs while others have none. This is completely normal. You’ll report actual activity during each period, not artificially smoothed averages.

Correcting Mistakes in Quarterly Updates

Errors in quarterly submissions can be corrected in subsequent updates or through your annual final declaration. If you discover a mistake shortly after submission, you can make adjustments in the next quarter rather than immediately correcting the error. However, significant errors should be corrected promptly to avoid confusion in your annual reconciliation.

Nil Returns and Low Activity Periods

You must submit quarterly updates even if you had no income or expenses during a particular quarter. For example, if your property was vacant or if you had no rental activity for other reasons. Your software will generate a “nil return” showing zero activity for that period.

Making the Final Declaration

On 31 January, you’ll still need to pull everything together. In MTD, this is done through a Final Declaration.

What it includes:

- Confirmation of all your income and expenses for the year.

- Application of allowances, reliefs, and adjustments.

- Any corrections not captured in your quarterly updates.

- Finalising the tax position.

The deadline for the Final Declaration is still 31 January, following the end of the tax year. So, for the 2026/27 tax year, you’d submit by 31 January 2028. That timing will feel familiar if you’ve been used to Self-Assessment.

How the MTD Cycle Works in Practice

The complete MTD process follows a logical annual cycle that spreads compliance work evenly rather than concentrating it at year-end:

Throughout the Year

You’ll record transactions digitally as they occur, using appropriate HMRC categories for your business and property activities.

Every Quarter

You’ll send progress updates showing cumulative income and expenses, making corrections for any errors discovered since your previous update.

At Year-End

You’ll submit your final declaration integrating quarterly data with adjustments, reliefs, and non-MTD income sources.

Other Income Sources

Employment income, pensions, dividends, and capital gains continue to be reported through the usual Self-Assessment processes. MTD only covers self-employment and property income.