RentalBux: One-Stop for Property Management and Accounting

Efficiency and accuracy are crucial in the property management sector. Handling properties, tenants, and finances requires a delicate balance that can feel overwhelming. If you are thinking of hiring a separate manager to manage all your property businesses, stop right there because you may only need a software to do all that.

RentalBux, is an innovative software that not only simplifies property management but also offers a set of advanced accounting features. It revolutionises the way landlords manage their properties while maintaining financial records. Here we will explore the property management and accounting features of RentalBux.

Streamlined Property Management

RentalBux offers a user-friendly and intuitive platform that has revolutionised property management. Landlords now have the ability to efficiently manage multiple properties and units, handling everything from lease agreements to maintenance requests, all from a single centralised dashboard. This streamlined approach to administrative tasks allows landlords to prioritise delivering outstanding service to their tenants, ensuring a seamless and stress-free rental experience for all parties involved.

Advanced Accounting Capabilities

RentalBux truly shines in its advanced accounting features. Let us take a closer look at how RentalBux simplifies financial management for landlords:

1. Journal

Journals are a book of records to track each and every income and expenses. RentalBux provides an extensive journaling feature that enables landlords to effortlessly document all types of financial transactions associated with their properties. Landlords can accurately record details such as rental income, property expenses, maintenance costs, and other relevant financial activities.

You can add new entries through the Add Journal button, view details of existing financial transactions, filter through the list by date and also export the document. This documentation ensures that landlords have a transparent and reliable audit trail to track and manage their financial affairs effectively.

Other than these features, RentalBux has an impressive array of accounting features. As soon as a user saves an invoice, the invoice is automatically reflected in the Journal. However, if you save the invoice as a draft it will not be added to the Journal Post. Also, invoices are created as drafts in every quarter according to the tenancy period.

2. Ledger

RentalBux’s ledger feature allows landlords to keep thorough records for each property, monitoring income, expenses, and other financial activities. You can also filter the lists according to your property, accounts, and date. In addition, you can hide zero balance to track all your income and expenses. Furthermore, the export feature can be used to share the document with a financial manager or accounting expert. The ledger offers a complete summary of the financial status of each property, enabling landlords to make well-informed decisions about their investments.

3. Trial Balance

RentalBux’s trial balance feature helps landlords make sure their financial records are correct. They do this by comparing the total of what they owe with what they are owed. Then they check this against their detailed account records which can be found in the Journal and Ledger sections. This helps them find and fix any mistakes.

Additionally, you can view the debit and credit values of the opening balance, transaction, and closing balance under this section. So, you can track each and every financial record.

4. Income Statement

RentalBux provides landlords with comprehensive income statements that offer a detailed breakdown of both the income and expenses related to each of their properties. This allows landlords to evaluate the profitability of their rental properties and pinpoint specific areas quickly and effectively for enhancement, enabling them to optimise their rental income.

5. Balance Sheet

RentalBux’s balance sheet feature gives landlords a clear picture of their financial situation at any time. It shows what they own, what they owe, and their overall financial standing. In accounting words, the balance sheet includes details about your assets, liabilities, and equity. This helps landlords make well-informed decisions about their investments.

6. Bank Reconciliation

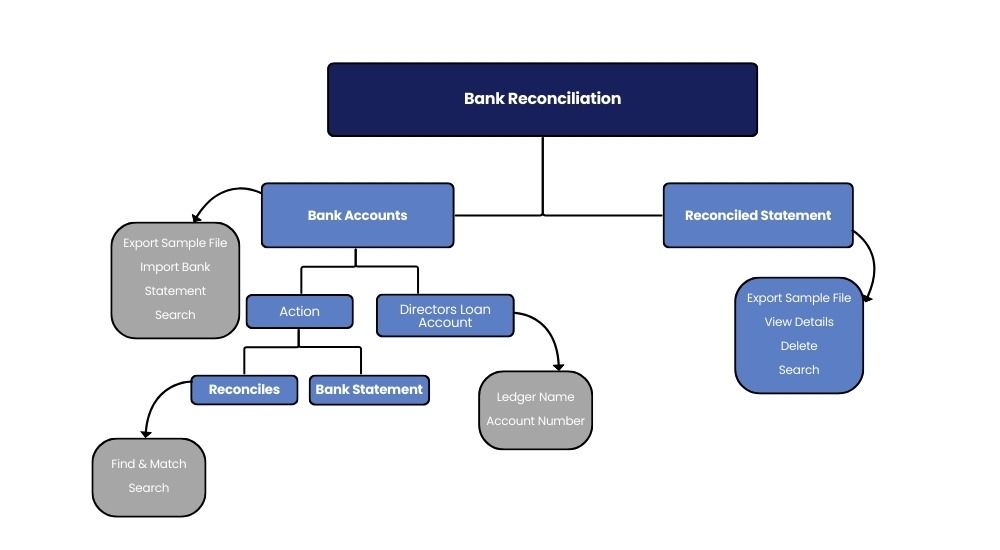

RentalBux streamlines the bank reconciliation process by automatically comparing bank transactions with ledger entries. This enables landlords to promptly detect any discrepancies between their bank statements and accounting records, thereby guaranteeing precise financial reporting and record-keeping.

Furthermore, RentalBux provides the Find & Match feature to balance out any income or expenses in your financial records. To use the feature, you must go to the Bank Reconciliation section, then Bank Accounts, then under the Action column go to Reconciles. Also, you can view the lists of all reconciled items under the Reconciled Statement section.

Additionally, you can also import the bank statement by downloading a valid bank statement Excel sheet so that our system can properly read and understand your financial records. All these features can help you keep track of your financial records during your auditing process. Not to mention the hassle-free information it provides during any tax returns.

Conclusion

In today’s demanding real estate market, landlords must have efficient property management and accurate accounting practices in place to thrive. RentalBux provides landlords with the tools to streamline their property management processes and maintain precise financial records. From detailed journaling to seamless bank reconciliation, RentalBux offers a comprehensive range of accounting features, empowering landlords to confidently take charge of their properties and finances. Discover the transformative impact of RentalBux and harness the true potential of your rental properties.