MTD for Jointly Owned Properties: How Landlords Should Report Rental Income

Across the UK, many houses, flats, offices, and shops are owned by not just one, but two or more people. Couples can own a buy-to-let, siblings can inherit a property, or business partners can pool their investment in a portfolio of properties. Joint ownership is not unusual, but it raises particular problems when making reports of rental profits using Making Tax Digital (MTD).

From April 2026, co-owners are obliged to keep records digitally and report their proportion of income and expenses separately to HMRC. A single submission that was otherwise manageable is turned into a multi-faceted reporting requirement. It can appear complicated for landlords and accountants where proportions of ownership alter, or properties exist within large portfolios.

However, MTD gives joint owners the means to bring transparency into joint property arrangements, track income and spending in real time, and simplify end-of-year reporting pain. It’s a chance for accountants and advisers to facilitate their clients’ journey through these reforms, while staying compliant and improving money control.

This guide outlines how MTD operates for jointly owned property, the specific reporting requirements of landlords, and how accountants and advisers can prepare clients in practice.

Who’s in Scope and When?

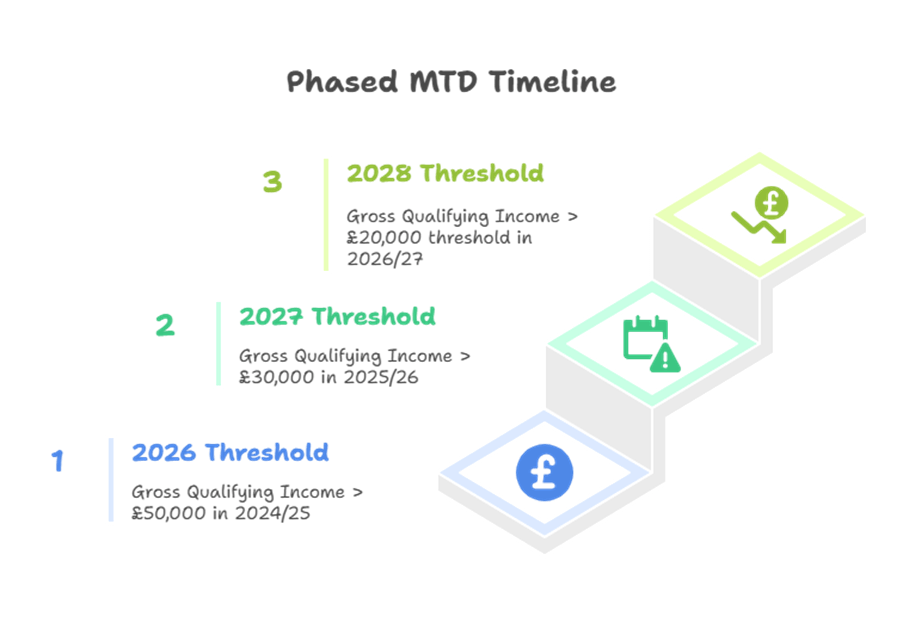

MTD ITSA is for Self-Assessment individuals with qualifying income above certain thresholds, applied on a per-head basis, not per business or per property. The individual share of each joint owner dictates their requirement, i.e., a co-owner may need MTD compliance but not another.

Qualifying income encompasses the total income from self-employment and property in a tax year, excluding all other sources of income like employment income, dividends, and partnership income, which do not contribute to qualifying income.

For joint property, HMRC will work out the share of each owner as reported on their Self-Assessment return. At a key point, where landlords receive only net payments (having already paid management fees), HMRC can use the net figure to determine thresholds, potentially restricting MTD exposure in some joint owners.

The customised nature of the threshold test presents planning opportunities; rearranging ownership percentages or timing income recognition can influence MTD mandation dates for specific co-owners.

What is the compliance requirement under MTD for Joint Property Owners?

Joint property owners currently only report their proportionate share of rent collected and costs on their yearly Self-Assessment return. By April 2026, this will change.

Under MTD for ITSA:

- Each joint owner will have to keep digital records of their proportionate share of income and expenses.

- Each joint owner will have to make quarterly updates submission to HMRC via MTD-compatible software.

- All joint owners must file a final declaration submission for property income at the end of the year, confirming their tax position.

Importantly, HMRC treats each individual as a separate taxpayer. Even though the property is jointly owned, there is no concept of a single “joint MTD account.” Instead, every joint owner is responsible for reporting their share digitally.

How Do Joint Landlords Record Income and Expenses Under MTD?

Digital records require three fundamental components: amount, date, and category, using the same income/expense categories as those in Self-Assessment. Maintain separate records per business (UK property, foreign property, self-employment), as HMRC will regard these as distinct sources of income.

Digital links preserve audit trails by not allowing manual re-keying once records are entered into the MTD system. The linking methods, including spreadsheet cell references, automated imports, portable device transfers (such as USB sticks), optical character recognition (OCR), and API connections, are acceptable. While manual data re-entry between software components or hand-transcription, breaking the digital chain is not acceptable.

For co-owned properties, the co-owners maintain separate digital records; no linkage between systems by owners is expected or required. Any one owner’s software configuration stands alone, minimising significantly technical demands.

Digital Record-Keeping Easement for Joint Properties

Joint property owners qualify for simplified digital record-keeping, which addresses the administrative challenges that co-owners face. Rather than maintaining detailed transaction-level records, joint landlords can create one digital record per income category per update period and one digital record per expense category per tax year.

In real terms, this would mean a joint landlord receiving £1,000 monthly rent, able to have a single £3,000 entry for Q1 rather than three separate monthly entries. Similarly, all jointly owned homes’ fixtures and fittings maintenance and repair costs can be amalgamated into yearly single records by category, without repeated data entry, but keeping the categorisation structure HMRC requires for correct tax workings.

Simplified Categorisation for those having turnover below VAT threshold, i.e.£90,000

Joint landlords whose total UK property income falls below £90,000 annually benefit from additional simplification: transactions need only be classified as “income” or “expense” rather than detailed Self-Assessment categories. However, residential landlords must still separately identify mortgage interest and other residential finance costs to preserve interest relief restrictions in tax calculations.

Importantly, if property turnover exceeds £90,000 during the tax year, full categorisation becomes mandatory retrospectively from the start of that tax year. This threshold breach requires re-categorising all previously recorded transactions before year-end finalisation, making early adoption of full categorisation prudent for clients who may approach this threshold.

What Exactly Is a Quarterly Update Under MTD and What Goes In?

Joint landlords have two clear reporting options under MTD. These options are designed to make reporting easier while keeping a proper record for audits.

Option 1: Standard Reporting

In each quarterly update, include both the income and expenses for jointly owned properties using standard MTD procedures. This approach is the same as for solely owned properties and gives a complete picture for the quarter.

Option 2: Income-Only Updates

Report only income from jointly owned properties in quarterly updates, deferring all joint property expenses to year-end finalisation. This easement recognises that expense allocation between co-owners often requires period-end reconciliation.

It’s important to note that, despite the deferral for submission, all expenses must still be recorded digitally throughout the year and reported during the finalisation process.

Quarterly updates consist of cumulative category totals extracted from your digital records, rather than detailed transaction listings sent to HMRC. These are automated summaries that your chosen software generates from underlying data, similar to how VAT returns aggregate from your sales and purchase records.

Standard update periods align with the tax year:

| Quarters | Standard Period | Deadline |

| Quarter 1 | 6 April–5 July | 7 August |

| Quarter 2 | 6 April–5 October | 7 November |

| Quarter 3 | 6 April–5 January | 7 February |

| Quarter 4 | 6 April–5 April | 7 May |

Alternatively, calendar update periods ending on month-end dates carry identical deadlines. Updates contain no tax calculations or adjustments; the software estimates tax liability post-submission for information only. The real work happens in maintaining digital records that feed these quarterly summaries. Once MTD becomes mandatory, not during voluntary phases, missed deadlines trigger penalty points under HMRC’s new regime, making process discipline essential.

Which Update Periods Should We Use Standard or Calendar?

Landlords can choose between tax-year-aligned standard periods (6 April starts) or calendar periods ending on month-end dates. Make this choice in software before the first quarterly update and maintain consistency throughout the tax year.

Standard periods are suitable for landlords already aligned with the tax year for accounting purposes. Calendar periods often simplify reconciliations where accounting periods end on 31 March or where monthly management accounts drive the business rhythm.

Both options carry identical deadlines, so operational convenience should drive the decision rather than compliance timing.

Calendar periods may better suit landlords using property management software, generating monthly reports, while standard periods align naturally with annual Self-Assessment preparation cycles. Consider your existing workflow rhythm when choosing.

What Happens If We Make a Mistake Mid-Year?

MTD’s cumulative reporting structure enables natural error correction: automatic year-to-date update in the course of the year is directly carried over to the next quarter update without intervention. If you are discovering errors after the Q4 submission, correct the underlying records and resubmit Q4 before finalisation if changes affect totals reported.

Late Notifications

Where partners, trusts, or managing agents provide information after quarterly due dates, HMRC permits estimates or catch-up postings in subsequent submissions. Digital records can be maintained based on estimation, and when the final figures are available, they can be reconciled.

Practical Error Management

Implement soft-close procedures 10 days prior to quarterly due dates to gather late data and settle discrepancies. Maintain exception logs of records containing estimates, late notices, and corrections to demonstrate systematic error management.

How Should Rental Income Be Split Between Joint Owners?

The default rule is that rental income and expenses are split according to beneficial ownership.

Spouses and civil partners: By default, income is split 50/50, unless a valid Form 17 is filed with HMRC declaring unequal ownership.

Other joint owners (siblings, friends, business partners): Income is split in line with their actual beneficial share.

Under MTD, each joint owner must record and report only their share. For example, if two siblings own a property 60/40:

Owner A must record 60% of the rent and 60% of the expenses.

Owner B must record 40% of the rent and 40% of the expenses.

This might be complex, especially when bookkeeping software is shared or when landlords are not accustomed to apportioning transactions during the year.

How Do We Finalise the Year?

Year-end finalisation replaces the traditional Self-Assessment return submission with MTD’s integrated process for those having only mandated income. After Q4 submission, correct any identified errors in digital records, include any deferred joint property expenses, and resend Q4 if changes affect reported totals.

The software then guides you through the “finalise your Income Tax position and submit your tax return” journey, incorporating non-business income (employment, dividends, savings), claiming reliefs and allowances, and calculating final tax liability.

This process eliminates the separate “End of Period Statement” (EOPS) concept some practitioners remember from earlier MTD planning. HMRC’s current journey integrates quarterly business reporting with comprehensive annual tax return submission.

Finalisation deadlines follow normal Self-Assessment timing (31 January), but the preparatory work, correcting records, collecting joint property expenses, resending Q4 should begin immediately after the tax year end to avoid last-minute pressures.

What Does ‘Compatible Software Really Mean and When Is Bridging Sensible?

MTD-compatible software must satisfy four fundamental technical requirements, each carrying specific implications for joint property scenarios. The software must create and store digital records using HMRC’s prescribed income and expense categories, maintain unbroken digital links throughout the data processing chain, submit quarterly updates directly to HMRC’s systems, and support the year-end finalisation submission journey.

Understanding these requirements helps separate genuine MTD compliance from marketing claims. Compatible software doesn’t simply mean “cloud-based” or “modern”; it requires specific technical capabilities that many popular accounting packages still lack. For joint property owners, this compliance baseline becomes more complex due to the coordination requirements between co-owners and the need for sophisticated data segregation.

Joint Property Workflow Priorities: Essential Features

Software selection for joint properties demands features beyond standard landlord requirements. The system must provide clear segregation between solely and jointly owned properties at the data entry level, ensuring income and expenses route correctly without manual intervention.

The ability to provide income-only updates every quarter for joint properties is very important. Many accounting systems assume that all expenses are included in quarterly reports, which makes it hard to follow HMRC’s joint property rules. Choose software that allows for deferred expense reporting or flexible submission options, so you can provide income-only updates for certain property types.

Even when a landlord’s income is below the £90,000 threshold, it’s mandatory to separately flag residential finance costs. The software must clearly identify mortgage interest and finance costs apart from other expenses, keeping this distinction throughout the reporting process. This can surprise landlords who are moving from spreadsheets that don’t require this separation.

The ability to resend Q4 reports after making adjustments at year-end is crucial for joint property compliance. After adding deferred joint property expenses, landlords often need to revise their Q4 submission before final approval. The software must handle this resend process smoothly, updating totals without duplicating entries or disrupting the audit trail.

Advanced Features for Complex Joint Property Scenarios

Multi-entity reporting is helpful for landlords with different ownership types. The software should manage individual properties, shared properties, and partnership interests all in one place, while keeping separate reports for each. This approach cuts down on duplicate data entry and makes it easier to reconcile accounts.

Ownership percentage allocation tools streamline calculations for unequal beneficial ownership. Rather than manually calculating 60/40 or 70/30 splits, sophisticated software automatically apportions income and expenses based on configured ownership ratios. This automation reduces errors and simplifies ongoing maintenance when ownership structures change.

Agent integration capabilities facilitate data flows from property management companies. Many joint owners rely on managing agents who use their own software systems. MTD-compatible software should accept standardised data imports from common property management platforms, preserving digital links while reducing manual data entry.

Bridging Software Solutions

When landlords prefer Excel-based processes, bridging software offers a way to maintain familiar workflows while ensuring compliance with Making Tax Digital (MTD) regulations. However, careful implementation is essential to uphold digital link requirements and avoid manual errors that could compromise compliance.

Bridging solutions allow users to continue using Excel for data entry while automatically extracting MTD-compliant records for quarterly submissions. The software should monitor the Excel file for changes and update records accordingly, ensuring that no manual data transfers disrupt the digital link.

Template standardisation is crucial; Excel spreadsheets must follow consistent formats that the bridging software can interpret. This often means simplifying complex layouts in favour of standardised templates.

Effective version control and backup procedures are also necessary. Unlike cloud-based systems with automatic versioning, Excel workflows require strict file management to maintain data integrity. Establish protocols for file naming, backup timing, and access control to prevent data loss.

Penalties and Deadlines: What Changes Under MTD?

MTD introduces penalty points for late quarterly submissions once mandation begins, while testing and voluntary participation remain penalty-free.

How the Points-Based System Works

Under MTD’s penalty framework, landlords receive penalty points for each missed quarterly deadline rather than immediate financial penalties. For quarterly submissions (including MTD ITSA), the penalty threshold sits at 4 points. Once this threshold is reached, HMRC charges a £200 penalty for that failure and every subsequent late submission, though the points total stops increasing.

This structure creates a “learning curve” buffer, landlords can miss up to three quarterly deadlines before facing financial penalties, recognising that transitioning to quarterly reporting requires operational adjustment. However, once at the penalty threshold, every missed deadline triggers an immediate £200 charge.

Points Management and Recovery

Individual penalty points expire after 2 years from the month following the failure, but this expiry stops once landlords reach the penalty threshold. To reset points to zero after reaching the threshold, landlords must achieve 12 months of perfect compliance (meeting all submission deadlines) and submit all outstanding returns from the preceding 24 months.

The compliance period requirement emphasises consistent performance rather than occasional good behaviour. Missing a single deadline during the 12-month compliance period restarts the clock, maintaining pressure for systematic improvement.

Joint Ownership Penalty Implications

Joint property owners each have their own penalty responsibilities. Every co-owner has separate points and potential penalties based on their compliance performance. This means one co-owner can get penalty points while the other stays fully compliant, which could lead to tensions over administrative duties.

Because penalties are individual, joint ownership can be riskier. Sole owners face only one penalty risk, but joint properties can have multiple penalties if co-owners struggle with quarterly compliance. This highlights the need for strong process discipline in joint ownership situations.

Conclusion

Managing the reporting process for jointly owned property can seem complicated, but HMRC’s new rules make it easier. You can now report income every quarter for joint property in a straightforward way. Keeping digital records by category helps address the common challenges faced by joint owners.

To be successful, you need to plan ahead. This means accurately checking income thresholds, ensuring good data sharing from property managers, making software choices that work together, and sticking to a routine for quarterly reporting. Although you are moving from annual to quarterly reports, the fundamental tax requirements remain the same.

Joint property easements place jointly held properties on the same level, so they don’t impose greater administrative loads than single ownership. Good planning and systematic execution make MTD compliance a competitive advantage rather than an operational cost.

For landlords and practices preparing for April 2026 mandation, initiate threshold reviews immediately, map current workflows to MTD requirements, and lay software and process foundations well in advance of compliance deadlines. Early preparation transforms MTD from a regulatory burden into streamlined business administration.

FAQ

Do both joint owners require to join MTD if only one exceeds the threshold?

No. MTD applies individually based on each person’s share of qualifying income. Those co-owners whose qualifying income exceeds the threshold are mandated under MTD.

Can we send only one set of quarterly figures for a jointly owned property?

No. Each landlord submits their own quarterly updates showing their share. The easement allows reporting income-only for joint properties during the year, deferring expenses to year-end, but each owner must still file separate updates.

If our total property turnover is under £90,000, do we still need full categories?

You can simplify to basic income/expense categories, but residential landlords must still identify residential finance costs (mortgage interest) separately to preserve tax restrictions on interest relief.

Can we keep using spreadsheets?

Yes, with bridging software that maintains digital links. You cannot manually copy-paste between systems once MTD begins, but linked spreadsheets with proper bridging software remain compliant.

What if our letting agent only tells us our net share?

Request gross income and expense breakdowns. If unavailable during quarterly periods, HMRC permits estimates with later reconciliation, but you must finalise accurate figures before submitting your tax return.

Do we need to link our software with our co-owner’s system?

No. Co-owners maintain independent digital records and submission processes. There’s no requirement for system integration between joint owners.

Which deadlines apply if we choose calendar update periods?

Same as standard periods: 5 August, 5 November, 5 February, 5 May. The period structure changes, but deadlines remain consistent.

How long must we keep digital records?

At least 5 years after the 31 January deadline for the relevant tax year. Plan for software portability and continued access throughout the retention period.

Can I include other income (dividends, PAYE) in quarterly updates?

Other income stays outside quarterly updates but can be stored digitally within your software. Include these amounts during the year-end finalisation process.

Will partnerships be mandated, too?

Yes, but HMRC hasn’t confirmed timing. Current focus remains on individuals in Self Assessment, with partnership requirements expected to follow later.

What happens if we miss a quarterly deadline?

Late submission penalty points apply once MTD becomes mandatory. Points accumulate and trigger financial penalties at specified thresholds (explained above).

Are commercial properties treated differently under MTD? MTD mechanics (digital records, quarterly updates, finalisation) apply equally to residential and commercial letting. Joint property easements also apply regardless of property type, though accounting and tax treatments may differ outside MTD processes.