Making Tax Digital for Commercial Landlords: Key Rules and Exemptions

Making Tax Digital (MTD) for Income Tax represents a major change to UK tax compliance in decades, and commercial landlords, who rent shops, retail units, warehouses, and industrial premises, are firmly within its scope. Far from types of the property concern, MTD applies based on total qualifying income across all trading and property sources, meaning landlords of commercial property face the same digital reporting obligations as any other business.

From April 2026, landlords with qualifying income over £50,000 must comply with MTD. The changes affect how landlords must keep records digitally, report income and expenses quarterly, and finalise their tax position through a year-end final declaration. For commercial landlords, there is more money at stake with a higher number of transactions, and less margin for mistakes. Service charges, turnover rents, lease premiums, and VAT elections introduce additional layers of regulatory compliance rules.

For accountants and tax advisers, MTD creates a need for more sophisticated support services and places them squarely in the role of being an essential partner to their clients’ digitalisation. This article provides accountants, bookkeepers, and their commercial landlord clients with an end-to-end explanation of the rules and exemptions for MTD. We’ll cover who’s in scope and when, what records must be kept, how to handle commercial property complexities, and what exemptions may apply.

Who Must Comply with MTD from April 2026?

HMRC follows a phased structure, and the scope test for MTD targets qualifying income over the limit within a relevant tax year.

The Phased Rollout Structure

- From 6 April 2026: Individuals with overall annual turnover from self-employment and/or gross rental income from property of more than £50,000 must comply

- From 6 April 2027: The threshold reduces to £30,000

- From 6 April 2028: The threshold reduces again to £20,000

The government has indicated its intention to continue exploring ways of providing digitalisation benefits to the additional 4 million sole traders and landlords who have incomes below £20,000 annually, signalling further threshold reductions ahead in future years.

HMRC operates a “current year minus two” (CY-2) rule to determine mandation, considering your qualifying income from the previous year’s Self-Assessment return, which was filed two years prior to the start of the year of compliance.

For the 2026/27 tax year, starting in April 2026, HMRC applies the CY-2 rule by examining your 2024/25 Self-Assessment return, which is due by 31 January 2026, two years before your MTD obligations would start. If that 2024/25 return shows qualifying income exceeding £50,000, you’re mandated from 6 April 2026.

Mandation for April 2027 (£30,000 threshold) depends on the 2025/26 Self-Assessment return due by 31 January 2027

Mandation for April 2028 (£20,000 threshold) will be tested based on the 2026/27 return due by 31 January 2028.

Example: Take Marcus, who owns three office buildings generating £35,000 annually in base rent, plus £18,000 in service charges and parking fees. He also runs a small property management consultancy earning £15,000. His combined qualifying income of £68,000 on his 2024/25 return (filed by January 2026) triggers MTD obligations from April 2026, regardless of whether his actual 2025/26 or 2026/27 income drops below the threshold.

Entity Scope and Aggregation Rules

The aggregation rules are particularly important for commercial landlords. All trading income, UK property income, and overseas property income combine toward the threshold test. A landlord with multiple commercial properties, perhaps some residential buy-to-lets, and a small maintenance business must total all these income streams. The threshold is on gross rental receipts together with trading turnover from any trading operation, rather than net profit after deduction.

Joint Ownership Considerations: Joint property ownership means each owner’s share counts toward their individual threshold test. For jointly owned property generating £50,000, each 50% owner counts £25,000 toward their threshold. Joint ownership requires coordinated record-keeping between co-owners while maintaining separate digital records for each owner’s share. This becomes complex with unequal ownership percentages, shared service charge accounts, and joint decision-making on repairs and improvements. Each owner needs MTD-compatible software that can handle their ownership percentage while ensuring consistent categorisation prevents omissions or duplication.

Mixed Portfolios: All UK and foreign property, residential or commercial, or both, with income aggregates including self-employment income. A landlord with £30,000 from UK offices, £15,000 from Spanish apartments, and £10,000 from consultancy work, totalling £55,000, well above the April 2026 threshold, is required to comply under MTD.

Overseas property income counts toward UK MTD thresholds at gross level, potentially mandating landlords with otherwise modest UK activities. Foreign exchange translation creates additional complexity, requiring consistent methodology and supporting evidence. Record-keeping needs to meet both UK MTD requirements as well as any overseas tax requirements, with demanding integrated systems that manage multiple jurisdictions. Currency volatility adds timing complexity. Rental revenue received in a foreign currency will have to be translated into sterling, but should it be on invoice dates, payment dates, or period-average rates? A uniform approach is of the essence for compliance and audit trails.

Partnership Issues: While partnerships are not directly in MTD scope, individual partners with other qualifying income could still be caught. Example partner receiving £20,000 in property development from partnership property and £35,000 in private rental property would create individual MTD above £50,000. This creates reporting issues where partnership property income affects individual MTD levels but not partnership-level digital reporting.

What Counts Toward “Qualifying Income”?

HMRC tests qualifying income by totalling specific Self-Assessment boxes, making it essential to understand exactly what counts. For commercial landlords, the key boxes typically include business turnover from self-employment (if applicable), UK property income, lease premiums, reverse premiums, foreign property income, and foreign lease premiums.

Self-Employment Income:

- SA103F Box 15 or SA103S Box 9 (turnover)

- SA103F Box 16 or SA103S Box 10 (other income)

Property Income:

- SA105 Box 20 (UK property income)

- SA105 Box 22 (lease premiums)

- SA105 Box 23 (reverse premiums)

- SA106 Box 14 (foreign property income)

- SA106 Box 16 (foreign lease premiums)

For commercial landlords, typical qualifying income is normal base rent from shops and warehouses, service charges recovered from tenants, turnover rent from retail units, licence fees for car parks or signage, and any maintenance or management income if the property is a trade operation. Insurance recharges, utilities recharges, and similar cost recoveries also count as property income.

What do I have to File and When?

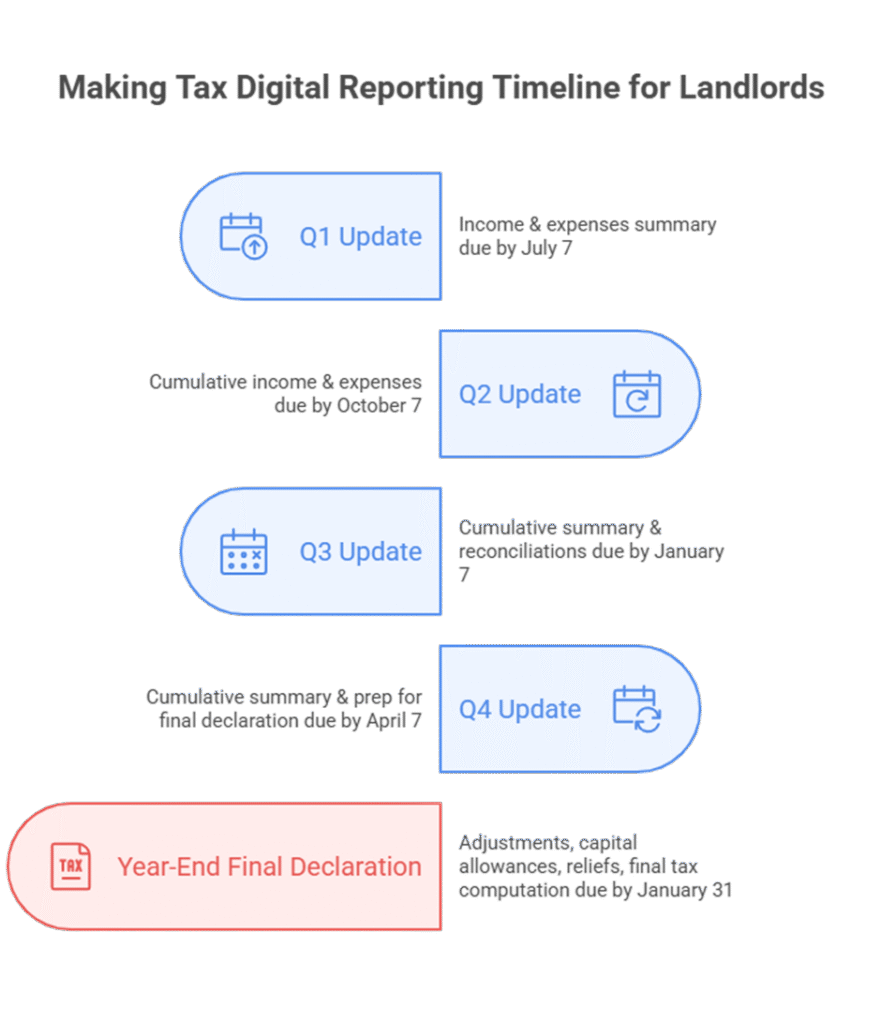

Making Tax Digital creates a two-stage reporting pattern: quarterly updates for each business source plus an end-of-year final declaration. This means that, rather than the single annual Self-Assessment return, earlier and more frequent, but initially less detailed, submissions are required under MTD for landlords and self-employed individuals.

Quarterly updates summarise income and expenses for each property business, providing HMRC with in-year visibility of trading performance. These updates capture the main financial flows but don’t include complex adjustments, reliefs, or allowances; those elements are finalised in the year-end final declaration.

The final declaration serves as the definitive tax computation, bringing together all income sources (property, trading, employment, pensions, investments) and applying reliefs, allowances, and adjustments. For commercial landlords, this includes capital allowances on qualifying plant and fixtures, which may not be captured in quarterly updates.

Agent workflows require new authorisation processes and task segregation. Clients must create authorisation links for their agents to submit updates, replacing simple form-signing with digital permissions. Agents require processes to prepare updates, review anomalies, and coordinate with clients prior to submission.

The quarterly rhythm demands new calendar management. Commercial landlords must establish routines for data capture, reconciliation, and review that fit within HMRC’s submission deadlines. Unlike Self Assessment’s single January deadline, MTD creates four quarterly deadlines plus the final declaration date. HMRC may adjust operational details as the MTD bedding period continues, making it essential to check current guidance before each quarterly cycle rather than relying on initial implementations.

What You Must Do Under MTD?

These are the compliance requirements for commercial landlords under MTD. Instead of storing records for an annual January submission, they will maintain digital records continuously and provide HMRC with updates every quarter, finalising the tax position at the year-end.

Step 1: Set Up Your Digital Record-Keeping System

Your first priority is adopting HMRC-compatible software that captures every commercial property transaction, comprising four essential elements: date, amount, HMRC category, and description. The manual records and basic spreadsheets won’t meet MTD requirements.

Income recording must cover:

Base Rental Streams: Standard rent, stepped increases, rent review adjustments

Service Charge Operations: Estimated collections, actual expenditure, reconciliation adjustments, arrears recoveries

Additional Revenue: Insurance recoveries, utilities recharges, commission income, management fees

Lease Transactions: Premiums received, reverse premiums paid, rent-free period valuations

Expense classification must cover:

Property Operations: Repairs, maintenance, mechanical systems, specialist equipment servicing

Professional Services: Legal fees, surveyor costs, planning consultants, and lease negotiation expenses

Financial Costs: Mortgage interest, commercial loans, arrangement fees, refinancing charges

Management Functions: Agent fees, letting costs, marketing, professional property services

Direct Service Provision: Staff costs, security, cleaning, utilities, maintenance contracts

Step 2: Handle VAT Integration Requirements

If you have opted to tax your properties and your qualifying income is greater than the MTD under Income tax threshold, you have double MTD issues, Income Tax and VAT compliance, dual systems with different deadlines and requirements.

Your software must therefore handle:

- Option-to-tax elections

- Mixed-use apportionments

- VAT on service charges

- VAT-inclusive and VAT-exclusive transaction recording

This requires systems capable of keeping separate but linked digital audit trails.

Step 3: Master the Quarterly Reporting Cycle

There will be a requirement of four quarterly submissions throughout the tax year.

These updates are cumulative, not individual quarters. Your Q2 submission covers the period from April to October, not just July to October. This allows error corrections in later submissions but demands consistent record-keeping throughout the year.

Each separate business requires individual quarterly updates. Own both office and warehouse portfolios? You’re submitting eight quarterly returns annually.

Step 4: Prepare for Year-End Finalisation

After your Q4 submission, you must complete a final declaration by 31 January covering elements not captured in quarterly updates:

- Year-End Adjustments: Accounting corrections, timing differences, accruals and prepayments

- Capital Allowances: Claims on qualifying plant, fixtures, and equipment purchases

- Income Integration: Bringing together property income with employment, pension, and investment income

- Relief Claims: Personal allowances, pension contributions, and other deductions

Step 5: Establish Monthly Management Routines

Quarterly deadlines demand monthly preparation. You cannot have quarter-end scrambles with commercial property complexity.

Monthly Responsibilities Include:

- Reconciliation of all property accounts in the bank

- Reconciliation of service charges and variance analysis

- Document filing with electronic links to transactions

- Exception reporting to flag coding errors or missed transactions

- Reconciliation of VAT for opted properties

Step 6: Build Quality Control Processes

Commercial property errors carry higher stakes than residential mistakes. Establish approval processes that match the complexity:

- Draft Preparation: Initial data compilation and categorisation

- Internal Review: Error checking, variance analysis, and completeness verification

- Client/Director Approval: Final sign-off before HMRC submission

- Submission Tracking: Confirmation of successful filing and obligation fulfilment

- Documentation Standards: Maintain version control for working papers, preserve submission files, and create remediation logs tracking corrections and process improvements.

The Reality Check

This isn’t just “digitising” your existing processes, it’s rebuilding your entire approach to property financial management. The quarterly cycle demands consistent attention rather than annual sprints. The categorisation requirements should align with HMRC guidelines. The integration with VAT adds another layer of compliance coordination.

However, landlords who establish robust systems early often discover that MTD provides better cash flow visibility, reduces year-end stress, and creates stronger foundations for portfolio decisions. The key is treating MTD as an operational transformation rather than a mere compliance obligation.

Your immediate priority should be software selection and staff training; these take months to implement effectively, not weeks. The quarterly deadlines are unforgiving, but the preparation timeline is entirely within your control.

What does “HMRC-compatible” Software Mean, and How Do I Choose It?

HMRC-compatible software must meet specific technical standards for maintaining digital records and submitting quarterly updates, but commercial landlords require functionality beyond basic compliance to effectively manage their property complexities.

The compatibility requirement covers digital record-keeping, calculation engines, and submission protocols. Software must maintain digital links between bank feeds, invoicing systems, and submission details to prevent re-keying that breaks the digital chain. However, basic compatibility does not guarantee commercial property features landlords need.

Commercial landlords need to consider software against set criteria, such as

- service charge management, dealing with on-account collections and year-end reconciliations,

- turnover rent logic that handles percentage calculation and tenant reporting timescales,

- VAT management for opted-to-tax properties in terms of mixed-rate scenarios,

- multiple property and tenant management with open cost allocation, and

- audit trails suitable for higher-value transactions and professional examination.

Integration functionality becomes a must for large portfolios. Bank feeds must handle large numbers of accounts, like service charge accounts, rent collection accounts, and general business accounts. A property management system integration must be capable of importing tenant data, lease terms, and rent review information. Document repository links should connect lease documents, certificates, and correspondence to relevant transactions.

Specialised property management software, such as RentalBux, offers comprehensive MTD compliance alongside property-specific functionality, addressing both regulatory requirements and operational needs in integrated platforms designed specifically for landlords. Our in-house software provides more sophisticated property management features than generic accounting software while maintaining full MTD compatibility.

Agent workflows require specific attention to authorisation processes and task segregation. Clients must create authorisation links for their agents to submit updates; this isn’t a simple signature but an active digital permission that client’s control. Agents need software that separates draft construction, client feedback, and ultimate submission stages.

The software selection process should include trial periods covering full quarterly cycles, not just initial setup. Commercial property seasonality, service charge cycles, and rent review trends need to be tested across quarters in a bid to find functionality gaps before go-live.

HMRC releases up-to-date software guidance but aimed at compatibility rather than feature richness. Commercial landlords need more software than minimum standards of compliance to properly address their operational complexity.

Who can apply to be exempt, and how does the income exemption work?

Making Tax Digital exemptions fall into two broad categories: income-based exemptions and digital exclusion exemptions, each with different application processes and evidence requirements.

Income-based exemption

If your qualifying income is below the relevant threshold for the tax year in question. HMRC applies the same look-back test used for mandating conditions, based on your Self-Assessment return.

Below Threshold:

Landlords below thresholds aren’t mandated and need to take no action, though they should monitor future income growth against upcoming threshold levels.

Exit Rule:

For existing landlords who experience a drop in income, the three-consecutive-years provision is an escape for them. The qualifying income should not be more than the relevant threshold for three consecutive full tax years prior to HMRC removing the mandate. This prevents temporary drops, causing administrative churn with negligible real relief for considerably reduced activities.

Digital exclusion exemptions

HMRC recognises situations in which digital record-keeping and quarterly reporting are not reasonably practicable. Exemptions may be granted on grounds of age, disability, remote location with inadequate connectivity, and certain religious reasons. Such exemptions entail a formal application, supported by evidence, and a decision from HMRC.

The application process demands clear documentation. Age-related applications need evidence of digital difficulties, not just birth certificates. Disability exemptions require a professional assessment of how MTD requirements interact with the specific condition. Connectivity evidence from providers is needed for remote location claims, rather than relying on rural postcodes.

Circumstances can change, affecting exemption status. A landlord who has granted an age-related exemption and subsequently receives family IT support might find their exemption questioned. Digital infrastructure improvements in remote areas could affect connectivity-based exemptions. HMRC must be notified of any material changes that may affect the grounds for exemption.

Notably, some categories are outside of MTD by design, not by exemption. Companies await separate Corporation Tax MTD implementation. Certain partnership structures have different timing. These aren’t exemptions; they’re not yet within scope.

Conclusion

Making Tax Digital for Income Tax is no longer a distant concept; it represents the direction of HMRC’s entire approach to landlord taxation. Digital reporting, real-time information, and with expected thresholds falling, more entities will be drawn into scope, and tax will become increasingly integrated with business reporting.

For commercial landlords, the challenge is not simply quarterly submissions but adapting business models, processes, and governance to a new regulatory environment. Those who invest early in digital readiness will find themselves with stronger financial controls and sharper insights. Try our Those who delay may face disruption when the rules inevitably tighten further. Explore our HMRC approved software, Rentalbux to test digital process, build confidence before mtd mandation.

Accountants and tax advisers are no longer just compliance checkers; they will increasingly act as process designers, technology partners, and financial interpreters in a digital landscape where HMRC has visibility throughout the year. MTD is not the end point; it is the start of a wider digital tax system that landlords must be ready to navigate.