Can I Buy a House Through My Rental Business?

Buying a property through a rental business strategy has been gaining attraction in the UK. It is getting especially popular among landlords, developers, and portfolio investors. With increasing tax pressures on individual property owners, using a company can offer significant advantages.

But is buying a house through rental business is legal? Is it even tax-efficient? And most importantly; can you actually buy a house through your rental business?

In this article we are going to look through the legal, tax, mortgage and administrative aspects of purchasing residential property via a business structure in the UK. In addition, we will also highlight the pros and cons and offer practical steps for landlords who are considering this route.

Is It Legal for a Limited Company to Buy Residential in the UK?

The short answer is Yes. In the UK, a limited company can buy residential property. Many landlords now set up property businesses to hold buy-to-let properties rather than purchasing them in their personal names. Limited Companies typically buy property for the following purposes:

- Residential buy-to-let investments

- Commercial property for business operations

- Mixed-use properties that combine residential and commercial elements.

But before proceeding, it is necessary to ensure that the company’s articles of association allow property transactions as part of its business activities. The company must also be registered with Companies House and must have property letting or investment included in its business activities.

Why Landlords Use a Company to Buy Property?

In recent times, more UK landlords have been buying property through limited companies instead of buying it in their personal names. The shift is driven by tax changes, tighter lending rules, and a desire to build more professional or scalable portfolios. Here are the key reasons why landlords choose to invest through a company:

- Tax Efficiency:

- Corporation Tax Rates: Rental Income from property owned by a limited company is subject to Corporation Tax (currently 19% to 25% depending on profits), which is often lower than personal income tax rates for higher rate taxpayers.

- Mortgage Interest Deduction: Limited Companies can deduct the full amount of mortgage interest as a business expense, unlike individual landlords, who are restricted by personal tax relief rules.

- Asset Protection: With a limited company, your personal assets are legally separate from the business. If the company faces debts or legal claims, your personal exposure is limited. This provides peace of mind and helps landlords operate in a more professional, risk-managed way.

- Easier Succession and Inheritance Planning: Transferring shares in a company to family members or other parties is often more straightforward and tax-efficient than transferring ownership of individual properties. This allows for more structured estate planning, including:

- Gradual ownership transfer

- Family Trusts

- Use of alphabet share classes for income splitting

- Portfolio Growth: For property investors, using a limited company can make it easier to scale a property portfolio, as profits can be reinvested into additional properties without being subject to personal tax until dividends are paid out.

Can I Live in a House Owned by My Rental Business?

Yes, it is possible to purchase a residential property through a limited company and live in it, but there are tax implications and liabilities to consider. If the property is occupied by a shareholder or director of the company, it is classified as “dwelling house” by HMRC. When the property is sold, the limited company will be subject to an Annual Tax on Enveloped Dwellings (ATED) and potential Capital Gains Tax (CGT) charges.

The option to buy a property through a limited company in the UK can be an attractive strategy for property investors. The tax benefits can significantly increase your cash flow and profits over the lifetime of your investment.

Can I transfer my property to a limited company?

Yes, you can transfer property to a limited company. In most cases, the limited company that properties are being transferred to is known as Special Purpose Vehicle (SPV). Since, a limited company is considered a legally separate entity, the ownership of the property must be physically transferred to the company, allowing the special purpose vehicle to own the property.

The most tax-efficient way of moving property into a limited company is through what is known as incorporation relief. Even if incorporation relief is not an option, you can still transfer your property business, as there may still be tax advantages.

The main obstacle to avoid when transferring ownership to a limited company is that, in most cases, the shareholders and directors are often the same people that held the properties in their own personal name.

How to Buy a House Through Your Rental Business?

If you have already set up a rental business or you are planning to buy property through one, there is a structured way of doing so. Here is how the process works in the UK:

- Step 1: Set up a Limited Company

To begin, you need a UK-registered limited company. This company will legally purchase and own the property.

- Register on the official government site at www.gov.uk

- Choose a relevant SIC code, such as:

- 68209: “Other letting and operating of own or leased real estate”

- For property investment only, most landlords set up a Special Purpose Vehicle (SPV) company

- Step 2: Open a Business Bank Account

You must keep your business and personal finances separate. A business bank account is required to:

- Receive rental income

- Pay expenses like mortgage interest, maintenance, and insurance

- Track income and prepare accounts for HMRC

- Step 3: Secure a Buy-to-Let Mortgage for a Limited Company

Buying property through a company means applying for a limited company buy-to-let mortgage.

- These are different from personal Buy-to-Let mortgages

- Fewer lenders offer them, and rates are typically slightly higher

- Most lenders require:

- A minimum 25% deposit

- A persona; guarantee from directors

- Good company structure

- Step 4: Make the Property Purchase

Once your mortgage is approved and deposit is ready, your company can purchase the property. The legal process is similar to buying personally, but the buyer on the title deed is the company name, not yours.

- Step 5: Register the Property and Start Letting

Once the transaction completes

- The property will be registered with HM Land Registry in the company’s name

- You can now let the property and collect rental income through your company

- All income and expenses must go through the business account

- Profits are subject to Corporation Tax, not Income Tax

- Step 6: Keep proper Financial Records

A limited company must maintain formal records and comply with HMRC and Companies House rules.

You will need to:

- Submit annual accounts to Companies House

- File a Corporation Tax return to HMRC

- Pay Corporation Tax on net rental profits

- Possibly file Confirmation Statements.

Mortgage Considerations

When buying a house through your rental business, the mortgage process is different from a personal buy-to-let mortgage. Here is what you need to know:

- Limited Company Buy-to-Let Mortgages: Most lenders do not offer mortgages to companies. Mortgage is issued to the company and not you personally, and there are fewer products available in comparison to personal BTL.

- Interest Rates: Interest rates on company BTL mortgages are typically 0.5-1% higher than personal BTL rates. This is because lenders consider company lending riskier.

- Deposit Requirements: Most lenders require a minimum 25% deposit. In some cases, you may need 30-35%, especially if the com

Comparison between Company V/S Personal Buy-to-Let Mortgages

| Feature | Limited Company BTL Mortgage | Personal BTL Mortgage |

| Who is the borrower? | Your company | You Personally |

| Interest Rates | Usually higher by 0.5-1% | Lower |

| Deposit Requirement | Usually 25-35% | Often 20-25% |

| Personal Guarantee | Usually required | Not applicable |

| Tax Relief on Interest | Full deduction allowed | Only 20% basic rate relief |

| Product Choice | Fewer Options | More Widespread |

| Lending Criteria | Based on rent + company structure | Based on rent + personal income |

Tax Implications

Here is a breakdown of the main taxes you will need to understand:

- Corporation Tax vs. Income Tax

Profits made through limited companies are subject to Corporation Tax, which currently sits at 25% for profits above £250,000 and 19% for profits below £50,000. Companies that earn within these two limits pay tax at the main rate of 25%, albeit reduced by a Marginal relief. This is lower than the higher income tax rates for individuals earning £50,271 to £125,170 or Additional Income Tax rates of 45% for an income of over £125,140.

Profits from a limited company distributed as dividends are taxed again at the recipient’s marginal Income Tax rate. Whereas the companies pay Corporation Tax whether the profits are distributed as dividends or not.

- Capital Gains Tax (CGT)

When your company sells a property, it pays Corporation Tax on the gain. The maximum Capital Gains Tax rate for individuals is 28% for residential property. However, the annual tax-free allowance for individuals is higher. Moreover, your tax liability may also be lower when you sell the property.

- Stamp Duty Land Tax (SDLT)

Your company must pay SDLT on property purchases just like individuals but there is no first-time buyer relief and the 3% surcharge for additional properties always applies.

Legal Considerations when purchasing property through a company

There are several legal aspects to purchasing properties in the UK through a legal entity such as rental business, and they include the following:

- Company Structure must be suitable

Before purchasing, your company must be correctly set up to own property. The two most common options are a limited liability (LLC) or a limited partnership. The company’s Articles of Association must permit property ownership and leasing. You must file the appropriate formation documents with Companies House and pay the required fees.

- Conveyancing Process

The conveyancing process for investors who choose to buy a property through a limited company is more complex than when purchasing personally due to the additional legal requirements. You may need to appoint a solicitor experienced in corporate conveyancing.

Additional due diligence is required to verify the company owners and directors. Transferring the property into the company’s name will also require filing a transfer deed with HM Land Registry and paying the applicable stamp duty land tax.

- Director Responsibilities

As a director you must act in the company’s best interests and ensure proper decision-making. This is especially important if there are multiple directors or shareholders.

Financing Options When Buying a Limited Company Property

As property investor, you should explore these options to determine the best approach for your investment goals:

- Cash Purchase

A cash purchase is a financial strategy that allows you to buy property outright without needing a mortgage if you have sufficient cash reserves. Cash purchase allows you to avoid mortgage interest or lender fees. It also means faster and simpler conveyancing. However, it ties up a large amount of capital and mortgage interest relief will not be available.

- Interest-only Mortgage

With this option, your company only pays the interest each month and the loan principal is repaid later either as subsequent payments or as a lump sum. This will result in improved cash flow since there will be lower monthly repayments. It also maximises return on investment. However, interest-only mortgages carry more financial risk and can lead to higher long-term costs if held for many years.

- Repayment Mortgage

A repayment mortgage is the most common type of mortgage which requires you to pay mortgage interest, and a principal amount each month to repay the loan over the mortgage term fully. These mortgages are suitable for longer-term. However, there will be less cash flow since monthly repayments will be higher. It may also reduce capital available for buying other properties.

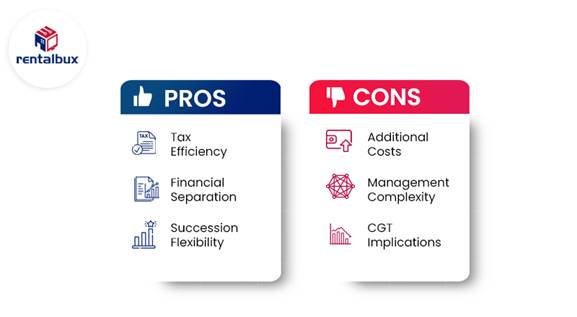

Advantages and Disadvantages of buying through a rental business

Advantages:

- Tax efficiency: One significant benefit is the potential tax savings. Limited companies are subject to corporation tax on their profits, which is 19% for profits up to £50,000 and 25% for profits over £250,000. This can be more favourable than the higher income tax rates individual property investors might face.

- Personal Financial Separation: Buying a property through a limited company can create a distinct separation between your personal finances and your investment assets. This means any liabilities associated with the property are confined to the company, potentially reducing your personal financial risk.

- Increased flexibility in succession planning: Owning property through a limited company can simplify succession planning. Instead of transferring ownership of a physical property, which can be hectic and tax-inefficient, you can transfer company shares.

Disadvantages

- Additional Costs: Limited company buy-to-let mortgages are rare and often have higher rates than personal buy-to-let mortgages. Many lenders do not offer buy-to-let mortgages to limited companies and when they do, they usually require a personal guarantee from a company director which means the director assumes financial liability. This can add to the financial burden when buying property through a limited company alongside additional costs such as accountancy and company registration fees.

- Complexity in management and compliance: Operating a limited company involves adhering to specific accounting and regulatory requirements. This includes filing annual accounts with Companies House and submitting corporation tax returns to HMRC. These obligations can add to the administrative burden.

- Capital Gains tax (CGT): A potential drawback of holding property in a limited company structure is if you decide to sell your shares in the company rather than the property itself, you will incur CGT on the gain from the share sale.

Common Mistakes to avoid when buying property through a company

Using a limited company to buy property can be tax-efficient and strategic—but only if you do it properly. Many landlords rush into incorporating without understanding the full picture, and that often leads to costly mistakes, compliance issues, or even tax penalties. Here are the most common mistakes property investors make when buying through a company, and how to avoid them.

- Using the Wrong SIC Code

Your company’s Standard Industrial Classification (SIC) code defines what type of business it is. For property investment, lenders and HMRC expect to see 68209 – “Other letting and operating of own or leased real estate.”

Using a trading SIC code (like construction or development) can:

- Raise red flags with mortgage lenders

- Delay applications or cause refusals

- Mixing Trading and Investment Activities

HMRC treats property trading (buy-to-sell or flipping) very differently from property investment (buy-to-let). If you mix both in the same company:

- You could lose tax benefits (e.g., interest deductibility)

- Mortgage lenders may reject your applications

- It may complicate your company accounts.

- Trying to Live in the Company-Owned Property

It is a common but serious error—thinking you can buy your next home through your company and live in it to save on tax. Unfortunately:

- It’s not allowed under buy-to-let mortgage terms

- It triggers Benefit in Kind tax on the full value

- It could attract penalties from HMRC and lenders

- Failing to File Annual Returns and Tax Documents

Unlike personal landlords, limited companies must meet strict reporting rules, including:

- Annual accounts to Companies House

- Corporation Tax return (CT600) to HMRC

- Confirmation statement each year

- Registering for ICO compliance if you manage tenant data

Missing these can result in:

- Fines

- Director disqualification

- Being struck off the register

- Transferring Personal Properties without tax advice

Transferring a personally owned rental into your company isn’t just an internal move—it’s legally a sale, and may trigger:

- Capital Gains Tax (CGT)

- Stamp Duty Land Tax (SDLT)

- Early mortgage repayment charges

Key Takeaways

- Yes, you can buy property through a limited company

- It is fully legal and common in the UK, especially for landlords using SPVs

- Company ownership offers tax advantages

- Full mortgage interest relief, lower Corporation Tax, and reinvestment benefits. However, dividend tax applies if you take money out.

- You will face higher administrative costs

- Expect higher rates, legal fees, and strict reporting duties with Companies House and HMRC.

- Personal use of company property is not allowed

- Living in the property triggers extra taxes and breaks lending rules.

- Transferring personal property into a company is complex

- It may lead to Capital Gains Tax, Stamp Duty, and refinancing challenges.

Conclusion

In conclusion, yes you can buy a house through your rental business in the UK and for many investors and landlords, the structure holds great significance. Holding property in a limited company can provide full mortgage interest relief, lower corporate tax rates, and greater flexibility when reinvesting profits or building a portfolio.

It is particularly attractive for higher-rate taxpayers and long-term investors aiming for scalable, tax-efficient growth. However, it is not without its drawbacks. You will face higher mortgage rates, more administrative responsibilities, and potential double taxation when withdrawing profits. For landlords with smaller portfolios or those looking for short-term income, buying property personally may still be more practical. Ultimately, the right choice depends on your income, goals, and how actively you plan to grow your property business.

FAQs

1. Is it cheaper to buy a house through a company?

Not always. While companies benefit from lower Corporation Tax and full mortgage interest relief, they also face higher mortgage rates, extra admin, and dividend tax when withdrawing profits. It’s more efficient for long-term growth, but not always cheaper upfront.

2. Can I transfer my personally owned properties into a company?

Yes, but it’s treated as a sale at market value, which means you may pay Capital Gains Tax (CGT) and Stamp Duty Land Tax (SDLT). You’ll also need to refinance your mortgages under the company’s name. Always seek advice before doing this.

3. How many properties should I have before using a company?

There’s no fixed number, but generally, if you own or plan to buy 3 or more properties, or if you’re a higher-rate taxpayer, using a company becomes more tax-efficient. It also helps with long-term planning and reinvestment.

4. Do I need a special mortgage to buy property through my company?

Yes. You’ll need a limited company buy-to-let mortgage, which usually comes with higher interest rates and stricter lending criteria. Most lenders will also require personal guarantees from the company directors.

5. What type of company should I use to buy property?

You should use a Special Purpose Vehicle (SPV) — a limited company set up specifically for holding property. It typically uses a SIC code like 68209 (Other letting and operating of own or leased real estate). SPVs are preferred by mortgage lenders and make your property business easier to manage and finance.