RentalBux MTD - Essential Kit

The ultimate MTD survival kit. Get everything you need to understand MTD and the requirements you need to fulfil in one single place.

The 12-Point Guide to MTD for Landlords

1. What is Making Tax Digital for Income Tax?

Making Tax Digital for Income Tax will change how you report your income to HMRC as a self-employed individual or landlord, introducing quarterly digital updates using compatible software and a final declaration on the year-end. This new reporting method will affect you if you earn over £50,000 from self-employment or property from April 2026, with thresholds reducing in subsequent years. You’ll benefit from enhanced accuracy through automated record-keeping, real-time financial and tax-position visibility through quarterly reporting and reduced administrative burden by eliminating year-end paperwork scrambles.

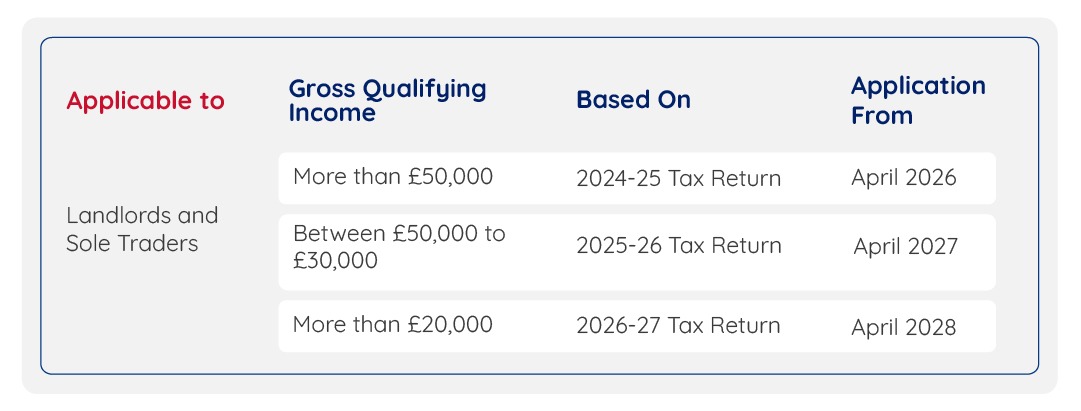

2. Who MTD Applies to?

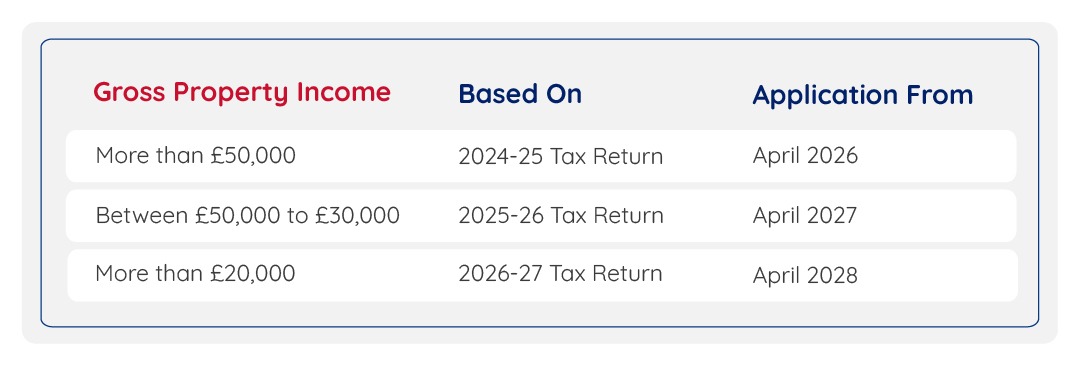

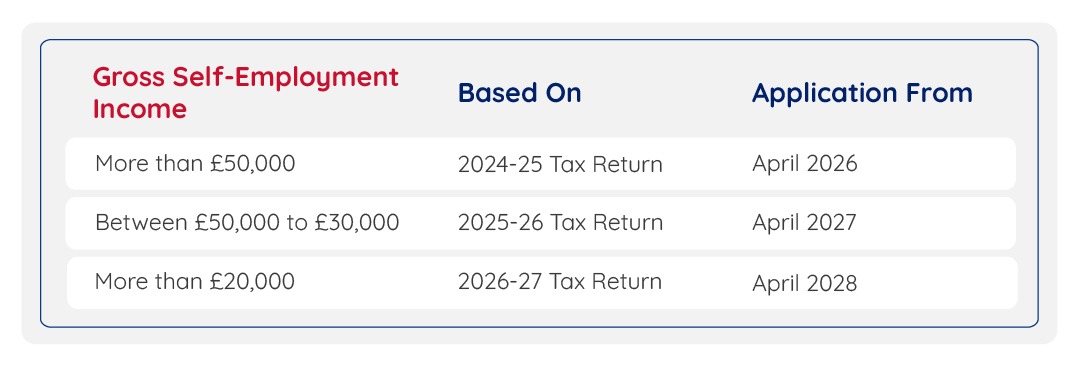

Making Tax Digital for Income Tax will apply to three groups: sole traders with self-employment income, landlords with rental income, and those who have both. Starting April 2026, you will owe taxes if your total gross income from these sources is more than £50,000. This threshold will decrease to £30,000 in 2027 and £20,000 in 2028. If you earn less than these amounts, you can still choose to opt in voluntarily to prepare in advance. Voluntary opt-in is available for those below the threshold who want to prepare early.

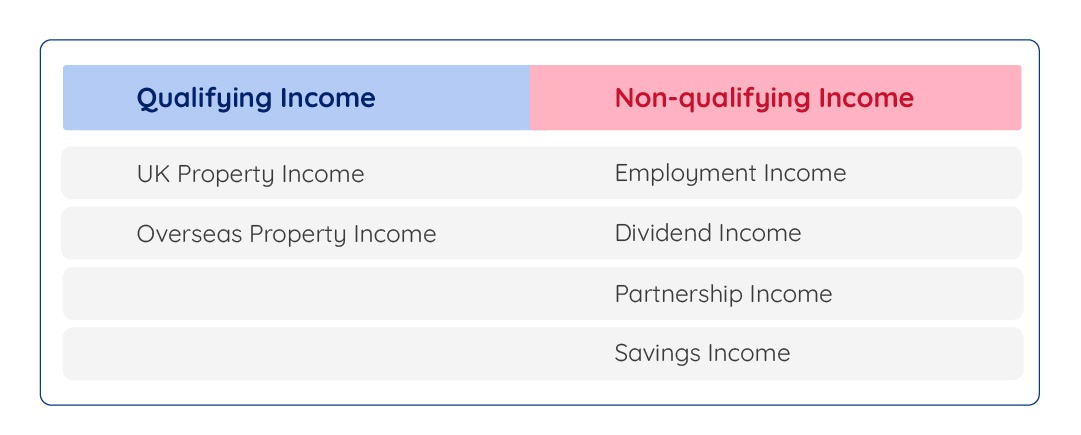

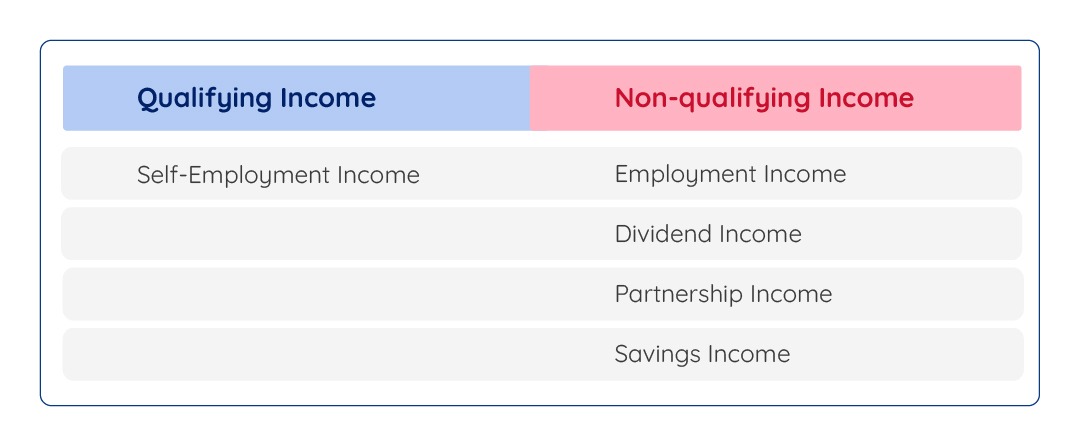

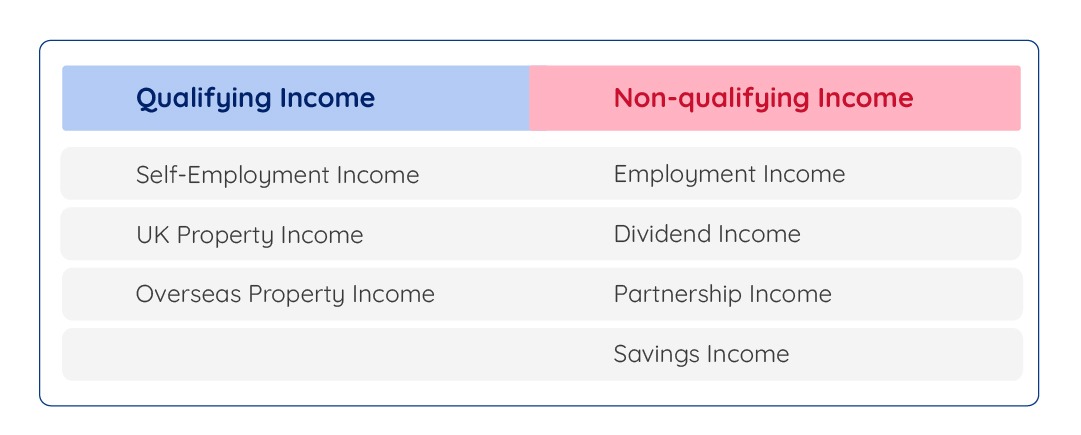

3. What counts as Qualifying income for MTD?

Qualifying income determines whether you’ll need to comply with Making Tax Digital for Income Tax and when your obligations will begin. HMRC calculates this using your gross turnover from self-employment and property rental before any expenses or deductions. Understanding what counts as qualifying income helps you plan for MTD requirements and avoid surprises when thresholds change. Your employment salary, pensions, and investment returns don’t count toward these thresholds, but all your self-employment turnover and rental income do, even if your actual profit is much lower. Getting this calculation right will determine your MTD timeline and preparation needs.

4.Who is exempt from MTD for Income Tax?

While most landlords and self-employed individuals with qualifying income above the threshold will need to follow Making Tax Digital for Income Tax, specific exemptions protect those who cannot comply with digital requirements. You may be excluded if your income is below the thresholds, you rely solely on employment or pension income, or if you encounter digital barriers due to age, disability, or location. Those under MTD exemptions can continue using traditional Self-Assessment methods while others transition. Understanding which exemptions apply helps you plan appropriately and avoid unnecessary compliance concerns.

5. When does MTD for Income Tax Start?

Making Tax Digital for Income Tax isn’t rolling out all at once. HMRC is phasing it in, starting with higher earners. The first phase, beginning April 2026, will affect sole traders and landlords whose combined self-employment and UK property income is £50,000 or more. Your start date depends on qualifying income from past tax returns, so you could begin in 2026, 2027, 2028, or remain outside the scope altogether. Understand when MTD begins for you, Learn more.

6. What are you required to do under MTD for income tax?

Once you’re within the scope of Making Tax Digital for Income Tax, you’ll face three main obligations: maintaining digital records throughout the year, submitting quarterly reports to HMRC, and completing an annual final declaration. It’s essentially spreading your current Self-Assessment workload across the year rather than cramming everything into January.

7. What are the MTD Compatible Software for Making Tax Digital?

Making Tax Digital for Income Tax requires HMRC-approved software to maintain digital records, submit quarterly updates and final declaration. There are two main types of software available for accounting: cloud-based accounting systems and bridging software. Cloud-based systems manage all aspects of accounting digitally, including record-keeping and submissions. In contrast, bridging software links your existing spreadsheets or desktop programs to HMRC systems. It’s important to understand these options to choose the software of your specific needs and compliance requirements.

8. What should I do if I Qualify for MTD?

Discovering you qualify for Making Tax Digital for Income Tax means it’s time to take action, but you don’t have to wait until the last minute. You can confirm your position, choose compatible software, and digitise your records at your own pace. Most importantly, HMRC’s voluntary pilot programme allows you to practice the entire MTD process before it becomes mandatory, submitting real quarterly updates and learning the system without incurring penalties.

9. What are the costs of compliance with MTD?

Making Tax Digital brings new compliance requirements that involve real costs for software, potential hardware updates, professional support, and your time. While these expenses are unavoidable, understanding them early helps you budget effectively and avoid surprises. The costs depend on the complexity of your business and your income level, but planning ahead ensures you can manage them strategically while gaining long-term efficiency benefits from digital systems.

10. How will accountants and tax agents help me?

Making Tax Digital can feel overwhelming when managing it independently, but accountants and tax agents provide essential support throughout the transition and beyond.They explain complex rules, help you choose and set up the right software, ensure accurate quarterly reports, and turn compliance requirements into useful business insights. Professional guidance reduces mistakes, saves time, and gives you peace of mind while turning MTD obligations into chances for better financial management.

11. What are the penalties for non-compliance with MTD?

HMRC has introduced a fairer penalty system for Making Tax Digital that uses penalty points rather than immediate fines for missed deadlines. Occasional slip-ups won’t trigger penalties straight away, but repeated failures result in financial consequences. Understanding how the points system works, when penalties apply, and how to avoid them helps you stay compliant while managing your obligations effectively without unnecessary stress or costs.

12. Where can I find more support and resources for MTD?

Making Tax Digital doesn’t have to feel overwhelming. HMRC provides official guidance, HMRC-approved software handles digital submissions, and professional accountants offer personalised support. The key is combining the right resources, tools, and advice to meet your needs and simplify compliance.

Making Tax Digital - Landlords: Ten-Step Checklist

1. Determine if You Need to Sign Up

If you are registered for Self-Assessment and receive property income (UK or foreign) you may need to sign up for MTD for Income tax once your gross property income (before expenses) exceeds the threshold mentioned in step 3.

2. Calculate Your Qualifying Income

3. Confirm Your MTD Start Date

4. Choose Compatible Software

Once you know that you are in the MTD scope, you must choose software that complies with the MTD ITSA requirements. It must be capable of keeping digital records of property income and expenses as per HMRC’s categorisation, sending quarterly updates to HMRC, and submitting the final tax return. If you are using spreadsheets, you will need bridging software.

5. Sign Up for MTD ITSA

Before signing up, make sure your HMRC details are up to date and that you have no outstanding tax. Have your property income start date and accounting method ready (cash or accruals). Register each property business separately, either yourself or through an agent.

6. Create and Maintain Digital Records

Keep separate digital records for each of your property businesses, including rental income, lease premiums, other property income, and allowable expenses like repairs, insurance, and mortgage interest. If your turnover from property is below the £90,000 VAT threshold, you can choose to submit simplified “three-line accounts” and categorise each item as income, expense, or net profit.

For joint properties, record only your share, and you can report total income in quarterly updates while deferring detailed expenses until year-end. Store or scan all invoices and receipts.

7. Send Quarterly Updates to HMRC

You must submit Quarterly updates to HMRC covering the following periods: 6 Apr–5 Jul (due by 5 Aug), 6 Jul–5 Oct (due by 5 Nov), 6 Oct–5 Jan (due by 5 Feb), and 6 Jan–5 Apr (due by 5 May). If you prefer using calendar quarters (e.g., 1 Apr–30 Jun), this must be selected in the software, although the due date remains the same. Even if there is no income or expense in a quarter, a nil return is still required.

8. Make Year-End Adjustments

After the fourth quarterly update, you need to make year-end adjustments. These include removing disallowable expenses (e.g., private portions of bills), applying available tax reliefs (such as Rent a Room relief), and making accounting adjustments for items like prepayments or accruals. If using the 1 April–31 March accounting period, you must also account for any income or expenses from 1–5 April.

9. Finalise and Submit the Tax Return

Using MTD-compatible software, you must finalise your Income Tax return by including all rental income, applying relevant adjustments, and declaring other taxable income such as dividends and bank interest. You must submit your completed return by 31 January following the end of the tax year, ensuring all details are accurate and complete.

10. Stay Compliant Moving Forward

After submission, you must retain the digital records for at least five years from the 31 January deadline. You must also ensure that all Self-Assessment tax payments are made on time by 31 January and 31 July if you have payments on account. If you start or stop a rental property business, notify HMRC using the appropriate online process.

Making Tax Digital - Sole Traders: Ten-Step Checklist

1. Determine if You Need to Sign Up

If you are registered for Self-Assessment and receive self-employment income, you may need to sign up for MTD for Income tax once your gross self-employment income (before expenses) exceeds the threshold mentioned in step 3.

2. Calculate Your Qualifying Income

You should calculate your qualifying income by including all gross turnover from self-employment before any expenses. If you are a UK-resident taxpayer, then foreign self-employment income should also be considered.

You must exclude other forms of income, such as dividends, employment income, partnership income (unless it includes disguised management fees), savings interest and foreign property income, if you are a non-UK resident.

3. Confirm Your MTD Start Date

Your start date for MTD ITSA depends on the level of gross self-employment income as reported on your tax returns. If your income exceeds £50,000 in your 2024–2025 return, you must start from April 2026. If it falls between £30,001 and £50,000 in the 2025–2026 return, your start date will be April 2027. If it falls between £20,001 and £30,000 in the 2026–2027 return, your start date will be April 2028. HMRC will notify you after your Self-Assessment submission.

4. Choose Compatible Software

You must use MTD-compliant software that can create, store, and correct digital records, send quarterly updates to HMRC, and submit your final return. If you’re using spreadsheets, bridging software will be required.

5. Sign Up for MTD ITSA

Before signing up, confirm your personal details with HMRC are accurate and that you have no outstanding tax liabilities. You’ll need your business name, start date, type of trade, and accounting method (cash basis or traditional). You can sign up for MTD yourself or appoint an agent to do it for you.

6. Create and Maintain Digital Records

Record all business income, including sales, fees, takings, and other income, along with allowable expenses such as stock, travel, and office costs. If your turnover from self-employment is below the £90,000 VAT threshold, you can choose to submit simplified “three-line accounts” and categorise each item as income, expense, or net profit.

If you run multiple businesses, keep separate records for each. Store or scan all invoices and receipts, and if you use spreadsheets, maintain digital links using bridging software.

7. Send Quarterly Updates to HMRC

You must submit Quarterly updates to HMRC covering the following periods: 6 Apr–5 Jul (due by 5 Aug), 6 Jul–5 Oct (due by 5 Nov), 6 Oct–5 Jan (due by 5 Feb), and 6 Jan–5 Apr (due by 5 May). If you prefer using calendar quarters (e.g., 1 Apr–30 Jun), this must be selected in the software, although the due date remains the same. Nil returns must be submitted even if there was no income or expense during a quarter.

8. Make Year-End Adjustments

After the fourth quarterly update, you’ll need to adjust for disallowable expenses (like personal use costs), prepayments, and accruals. If you use calendar-period reporting, you must also account for 1–5 April income and expenses. At this stage, you can also claim relevant tax reliefs such as capital allowances or the trading allowance.

9. Finalise and Submit Your Tax Return

Complete your Self-Assessment return via MTD-compatible software, including all other income such as employment, dividends, rental income, or interest. Your return must be submitted by 31 January following the end of the tax year. You must declare that the return is correct and complete before submission.

10. Stay Compliant Going Forward

You must keep all digital records for at least five years after the 31 January deadline. Ensure that all Self-Assessment payments, including payments on account, are made on time. Inform HMRC online if you start or cease a business or if any business details change. If your turnover exceeds £90,000, you’ll be required to submit fully categorised expenses from that year onward.

Making Tax Digital - Accountants/Agents: Ten-Step Checklist

1. Determine If Your Client Needs to Sign Up

2. Calculate the Client’s Qualifying Income

3. Create Your Agent Services Account (ASA)

If you don’t already have one, set up an Agent Services Account. You must be a director, partner, or sole trader of the firm to register. You’ll need the firm’s UTR, postcode, Companies House number (if applicable), VAT number, and anti-money laundering registration details. Keep ASA login credentials safe and separate from your traditional HMRC online services account.

4. Set Up Compatible Software

Choose MTD ITSA-compliant software that can keep and correct digital records, send quarterly updates, and submit final tax returns. Make sure it supports calendar-period updates if clients use a 1 April–31 March accounting year. It should handle multiple income sources (self-employment, UK and foreign property), and if spreadsheets are used, bridging software is required. Ensure it can also handle other income types like savings or dividends if relevant for your client.

5. Prepare Client Authorisation

Before signing your client up, ensure you have their permission. If you are already authorised for their Self-Assessment, link your client to your ASA. If not, request digital authorisation via your ASA to act on their behalf for MTD.

6. Sign Up Your Client for MTD ITSA

Confirm that your client meets MTD eligibility requirements, including voluntary early sign-ups if applicable. Gather necessary information, including the client’s full name, date of birth, National Insurance number, business name, address, start date, trade type, and accounting method. Then complete the sign-up through your ASA portal and ensure their software is connected to HMRC.

7. Maintain Your Client’s Digital Records

You must keep separate digital records for each of your clients’ self-employment trades and property businesses. These should include all property and self-employment related income and expenses. For jointly owned property, record only your client’s share. Supporting documents such as invoices and receipts must be stored or scanned.

8. Submit Quarterly Updates

9. Make Year-End Adjustments

After the fourth update, make necessary adjustments for disallowable expenses like personal use part, as well as prepayments and accruals. If using calendar-period updates, make adjustments for the period from 1 to 5 April. Apply relevant reliefs such as capital allowances, Rent a Room relief, or the trading allowance before finalising the return.

10. Finalise Client’s Tax Return & Ensure Ongoing Compliance

Ensure that all sources of your client’s income are accounted for in MTD-compatible software before submitting the final return. This must be submitted by 31 January following the end of the tax year. The client must confirm that the return is accurate and complete.

Keep all digital records for at least five years from the 31 January deadline. Notify HMRC promptly if your client starts, ceases, or changes a self-employment trade, property business, or other MTD-reportable activity. Also, support your clients with amendments or updates to software authorisations as needed.